The €1.375 Billion Irony: Following the Scent of a Billion-Euro Blind Spot

THE SCENT: A SEARCH FOR A TANGIBLE WHY

This investigation began not with a financial report, but with a human signal: a powerful public post from Dr. Kerstin Brehm, a former cardiac surgeon and the brand’s ideal customer. She described a lifelong loyalty to HUGO BOSS, yet a current reality of feeling like a “stylish afterthought”.

Dr. Brehm's question was simple and profound:

Why was a brand she loved making her feel invisible?

As The Strategic Bloodhound, my work is to follow signals in the shadows—these are the faintest of scents of customer disconnect that often lead to the heart of a company's greatest challenges. They are, as is so often the case, the clues hiding in plain sight, especially when a company fails to stay curious and look where others don't.

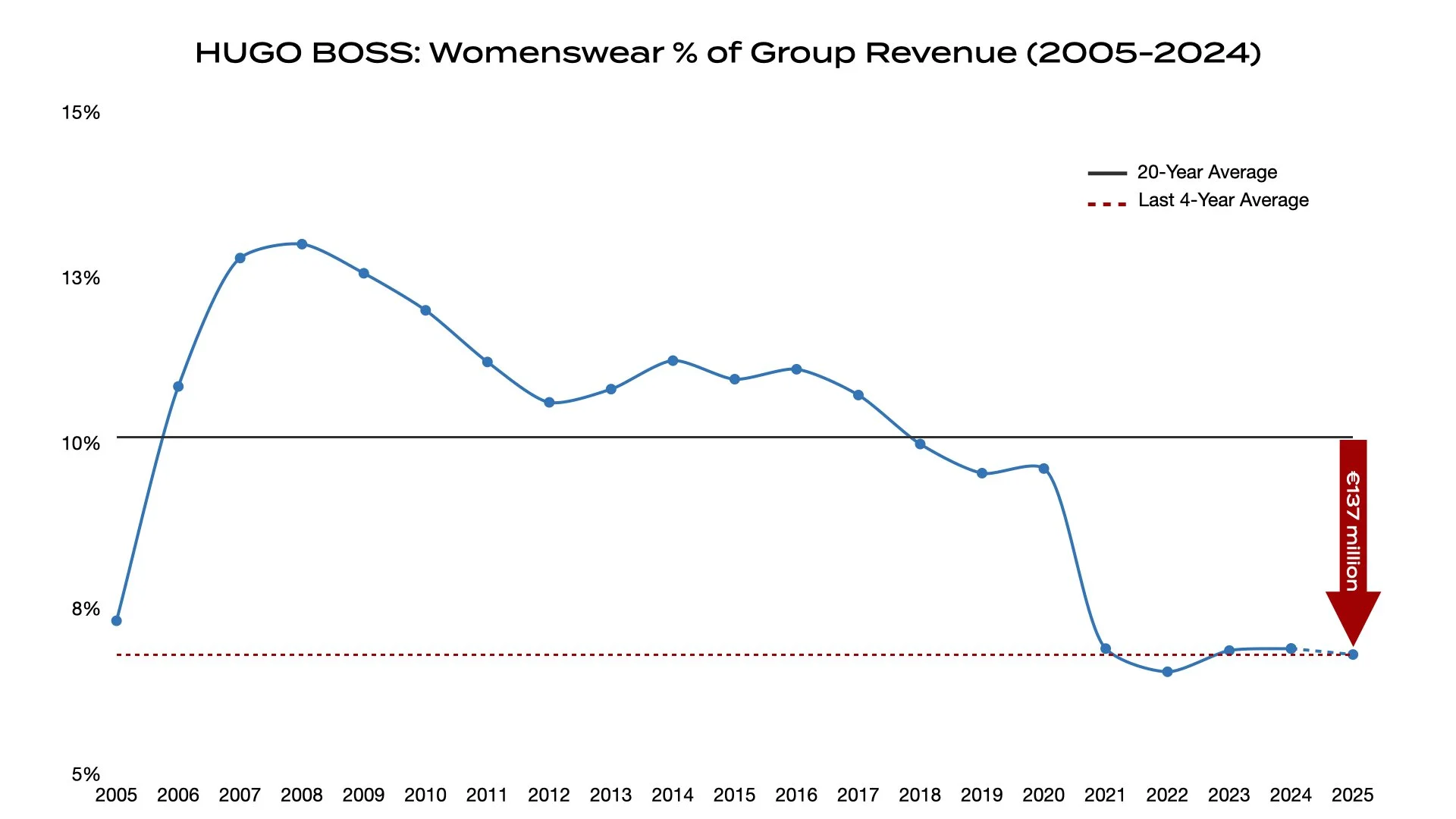

My first step was to determine if Dr. Brehm's sentiment was an isolated feeling or a quantifiable reality. A review of two decades of HUGO BOSS's own financial statements provided the unequivocal answer: her experience was the archetype of a womenswear division in a long and costly freefall.

But this data only showed what was happening, not;

Why?

This report follows that scent into the shadows to help answer Dr. Brehm's question. It details the investigation into the complex manoeuvres behind the decline and reveals the staggering, multi-billion-euro opportunity that remains hidden in the dark.

QUANTIFYING THE SCENT

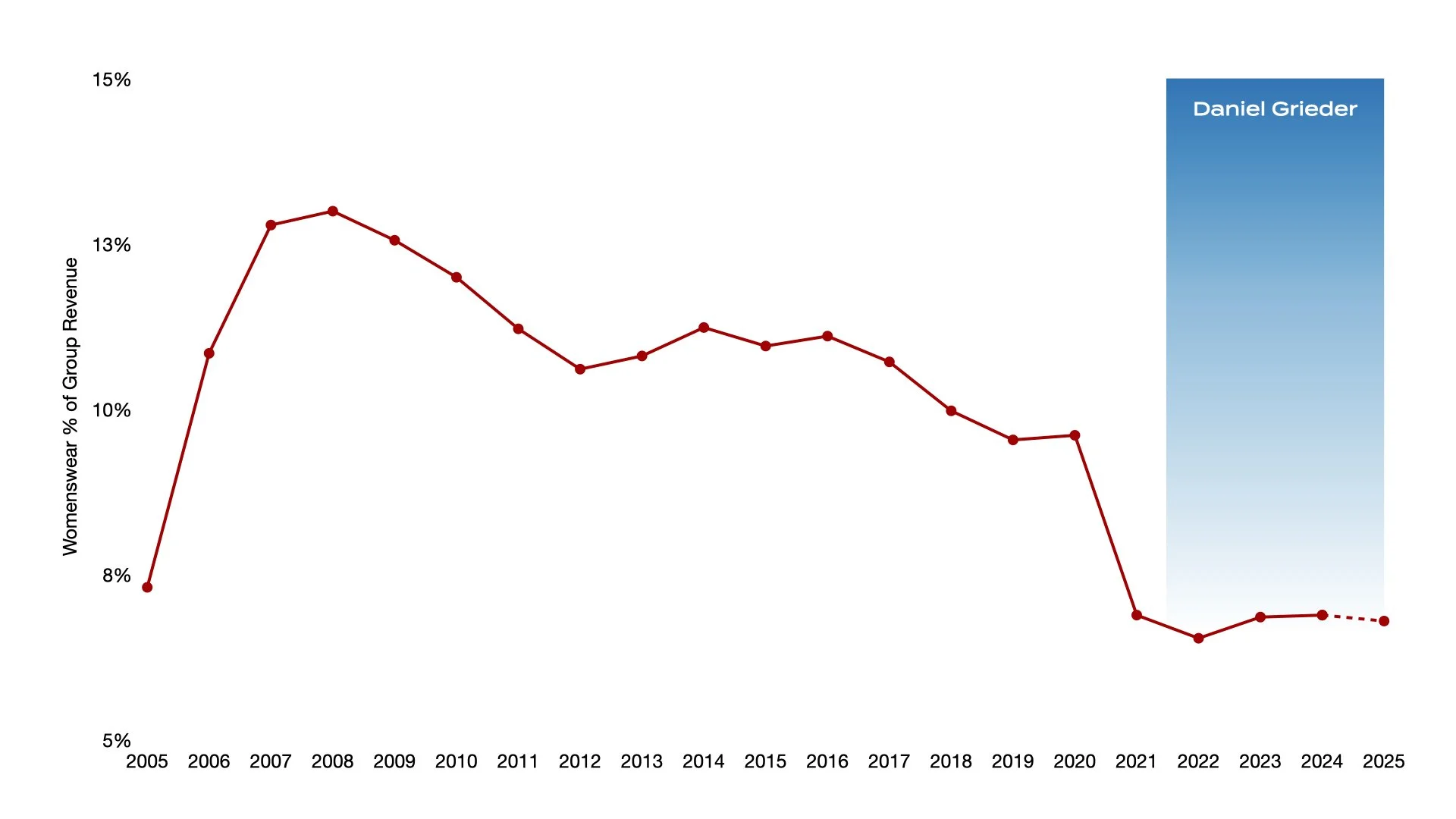

Dr. Brehm's feeling of being a "stylish afterthought" was not an isolated sentiment. It was a precise reflection of a quantifiable, two-decade-long reality visible in HUGO BOSS's own financial statements.The data trail is unequivocal. After peaking at over 13% of group revenue, the womenswear division entered a long decline, ultimately collapsing to an average of just 6.8% over the past four years.

The Streetlight Effect

To understand how a €137 million opportunity can remain invisible to a world-class company, this investigation applies the central principle from my book, Who Moved My Customers? The book is an organisational parable that reveals the fundamental why behind why companies falter: they consistently overlook the subtle, unseen shifts in customer loyalty and disconnects because they are not looking in the right places.

My approach is built on the principle that this challenge has been solved:

“VIRTUALLY ANYTHING THAT HAS AN EFFECT CAN BE OBSERVED, AND ITS IMPACT UNDERSTOOD, EVEN IF NOT WITH OLD RULERS.”

The core of this blindness is a cognitive bias known as the “Streetlight Effect”.

The story is simple:

A policeman on his nightly patrol finds a man on his hands and knees under a streetlight. "What are you doing?" the policeman asks.

"I'm looking for my keys”, the man says.

The policeman helps him search, but after finding nothing, he asks, "Are you absolutely sure you lost them right here?"

"No," the man replies, "I lost them in the park.”

"Then why on earth are you looking here?" the baffled policeman asks.

"Because," the man says, "this is where the light is.”

This parable perfectly illustrates the gravitational pull to focus only on visible, readily available data while ignoring the truths lurking in the shadows. The false “Illusion of Health” it fosters can be dangerously misleading, leading to misinformed decisions and value destruction.

The “Organisational CT Scan”—the diagnostic mindset taught in the book—is the key to seeing beyond this illusion. It’s the framework designed to help decision makers look past the bright light of familiar metrics to expose their organisation’s true operational health and make the invisible visible.

Applying this lens to HUGO BOSS allows us to understand its paradox. The following section will reveal what the company sees under its own bright streetlight—the official story of success that helps explain its billion-euro womenswear blind spot.

Under the Streetlight

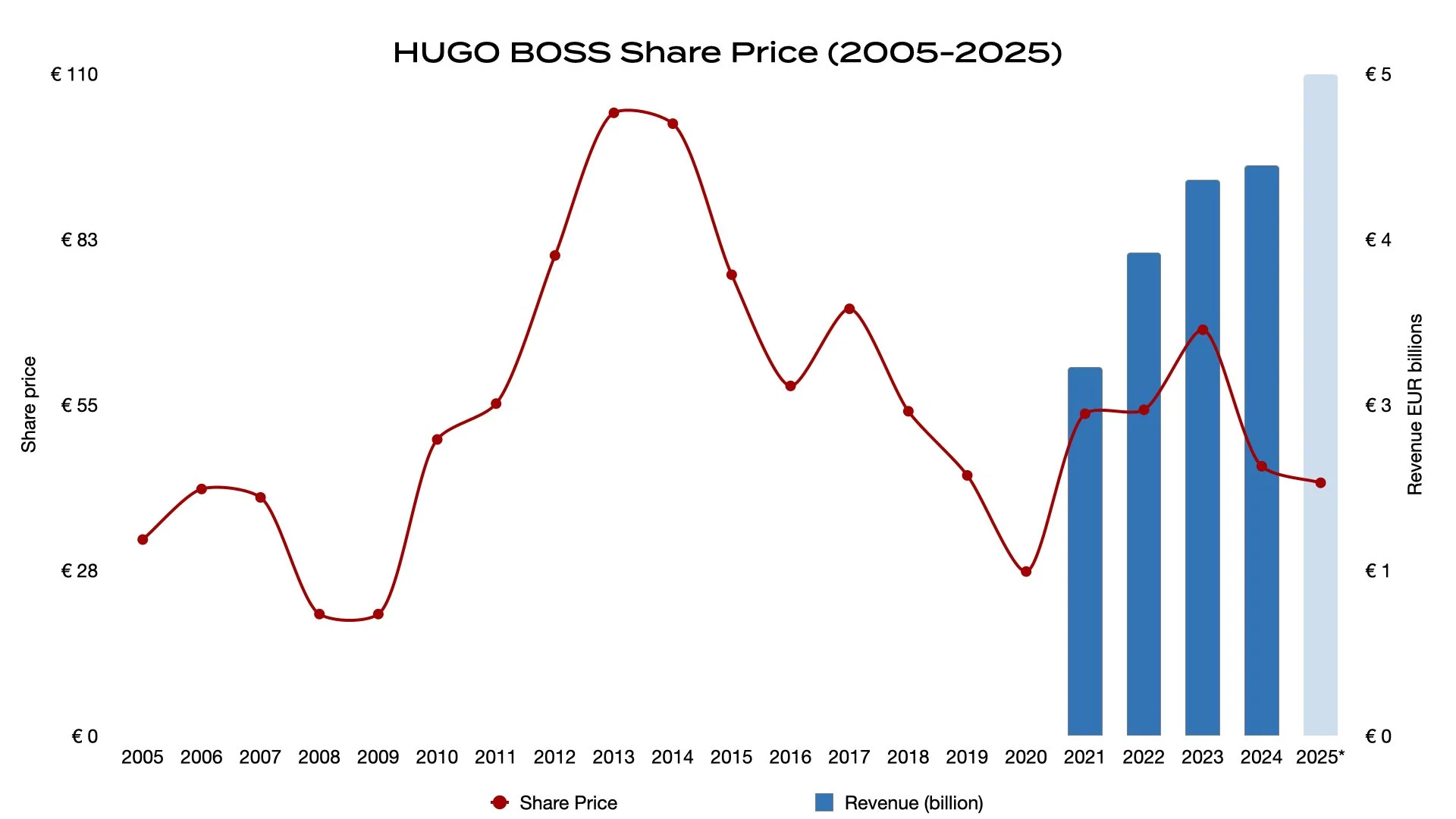

Under the bright light of its official narrative, HUGO BOSS is a resounding success. The 'CLAIM 5' strategy, implemented by CEO Daniel Grieder, has driven top-line revenue from €2.8 billion to a record-breaking €4.2 billion since 2021. The leadership is celebrated and has since set an ambitious new target of €5 billion in sales for 2025, accompanied by a 12% EBIT target.

In isolation, this top-line growth is impressive. This is the bright light where the company focuses its attention.

However, even within this bright light, anomalies appear in the periphery. Despite record-breaking revenue, the company's share price is depressed, and it has lost over €315 million in market capitalisation since Grieder took charge.

Furthermore, the most sophisticated analysts in the financial market are unconvinced. Following the June 2023 investor day, financial giants including Goldman Sachs, Deutsche Bank, and JP Morgan maintained "neutral" ratings.

This scepticism illuminates a classic financial dynamic... While leadership communicates success through the bright light of a profitability metric like EBIT, sophisticated investors are searching for truth in the shadows of the cash flow statement. This is the kind of thinking employed by legendary investors like Warren Buffett and Charlie Munger, who look beyond EBITDA for a simple reason: “Ignore working capital and capex, and you’re not looking at reality.” The market is signalling that it is looking at this deeper reality, not just the optics.

This disconnect between celebrated performance and market scepticism is the second clue that the whole story is not being told in the light. It is the central paradox that prompted this investigation into the shadows.

THE HUNT IN THE SHADOWS

Finding 1: The Cold Case of Wilful Blindness

The clues to the decline in womenswear and the market’s scepticism are not new discoveries. They are cold cases—a series of unheeded warnings presented directly to the company’s leadership over many years, long before the current ‘CLAIM 5’ strategy was conceived.

The following three findings are not presented as the sole causes of the decline, but as irrefutable symptoms of a deeper, systemic issue: a corporate culture that has consistently failed to see, value, and prioritise its female customer.

Sidebar: The Cold Case Files

2017—The Gender Gap:

An analysis presented to HUGO BOSS executives identified a potential 60/40 gender revenue split, representing a missed opportunity of over €750 million annually at the time.

2019—The Customer Disconnect:

A detailed customer report quantified a growing disconnect. It revealed that “sticky pathways” and other internal frictions—the “bad flora” in the company’s ecosystem—were actively eroding brand value to an estimated €834 million shortfall in womenswear revenue for that year alone.

2021—The Loyalty Collapse:

A follow-up analysis cautioned the company about an estimated €2.5 billion dilution in loyalty value stemming from these persistent blind spots.

Together, these previously ignored findings represent The Cost of Inaction—the price of being aware of massive, specific opportunities but failing to act.

The corporate reaction to this data... was consistently the same: disbelief. This is a classic symptom of “Organisational Homeostasis”—the state where a company becomes comfortable in an unhealthy but familiar equilibrium.

This history reveals the root of the problem. The issue has never been a lack of information, but a consistent failure to act on what was happening right outside the streetlight’s glow. These historical warnings were early-warning signals of the same systemic blind spot that the €1.375 billion opportunity quantifies today.

THE HUNT IN THE SHADOWS

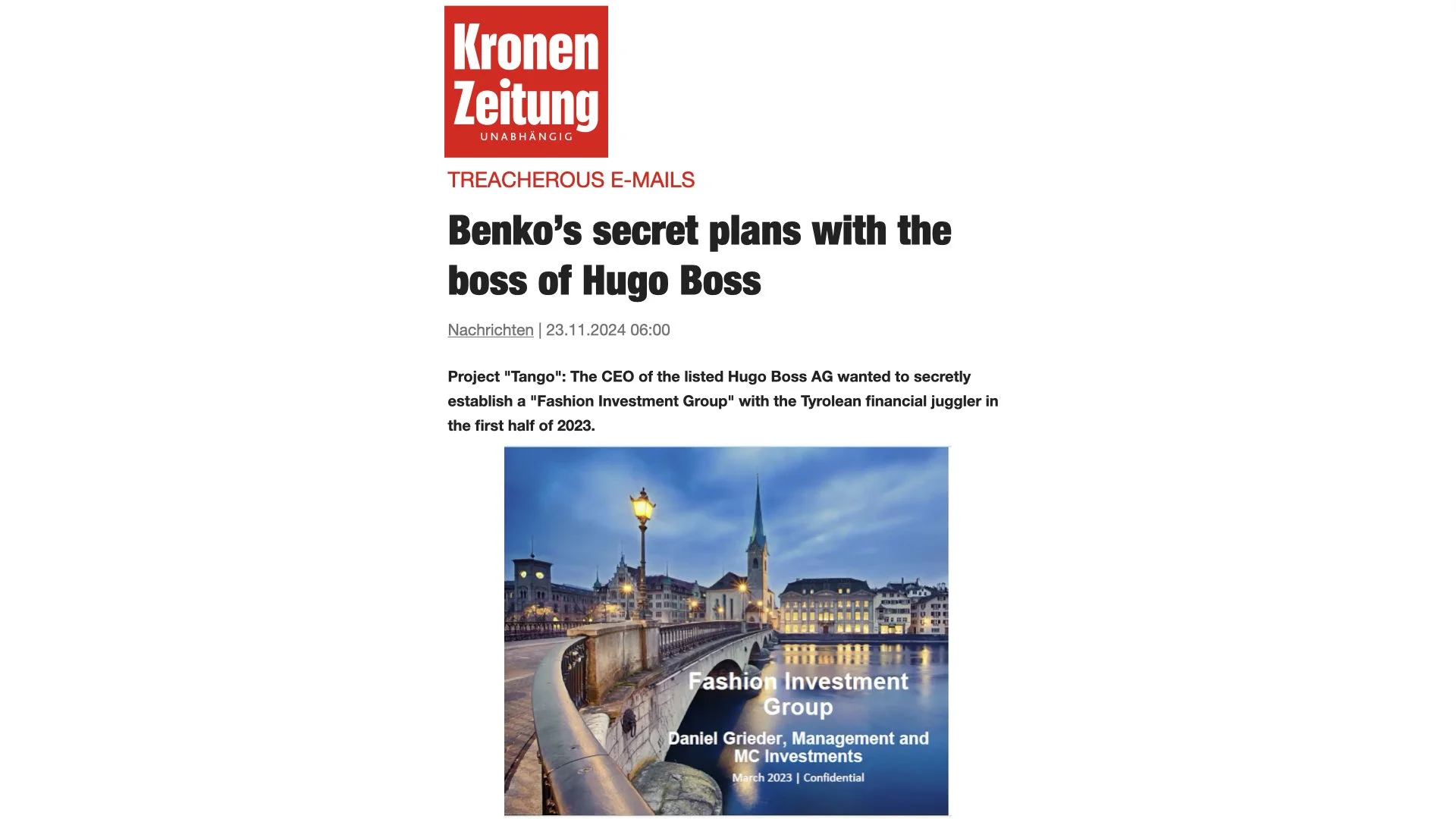

Finding 2: 'Project Tango' and Executive Distraction

The historical neglect detailed in the "Cold Case" files was recently compounded by a significant and controversial executive distraction. In 2023, the "Project Tango" affair erupted, providing a compelling theory for why the womenswear division continued to languish, even amidst the celebrated ‘CLAIM 5’ turnaround.

Sidebar: What was 'Project Tango’?

The Plan:

An alleged secret plan orchestrated by CEO Daniel Grieder and the now-disgraced tycoon René Benko to create a new, independent "Fashion Investment Group".

The Goal:

Grieder would eventually leave HUGO BOSS to lead this new empire after acquiring controlling stakes in major brands like Adidas, Bally, and Bogner.

The 'Smoking Gun’:

Evidence stems from a confidential email in which Grieder allegedly linked his new HUGO BOSS strategy announcement (the €5 billion target) directly to a potential share price increase, reportedly writing to Benko, "I believe this will drive the share price to very high levels".

The Fallout:

Grieder’s alleged partner, René Benko, now faces criminal charges for insolvency-related fraud following the collapse of his Signa Group empire.

While the full details of “Project Tango” remain in the shadows, the allegations alone paint a picture of a leadership team whose focus may have been on a speculative, external venture rather than on fixing long-standing, core business problems. This distraction, which allegedly focused on creating a new multi-billion-euro external empire, provides a powerful explanation for why a known, internal €137 million problem like womenswear remained off the radar.

Sources: Kronen Zeitung: https://www.krone.at/3602449

Financial Times: https://www.ft.com/content/a2200443-e920-45d4-a14c-37b89b9d1594

THE HUNT IN THE SHADOWS

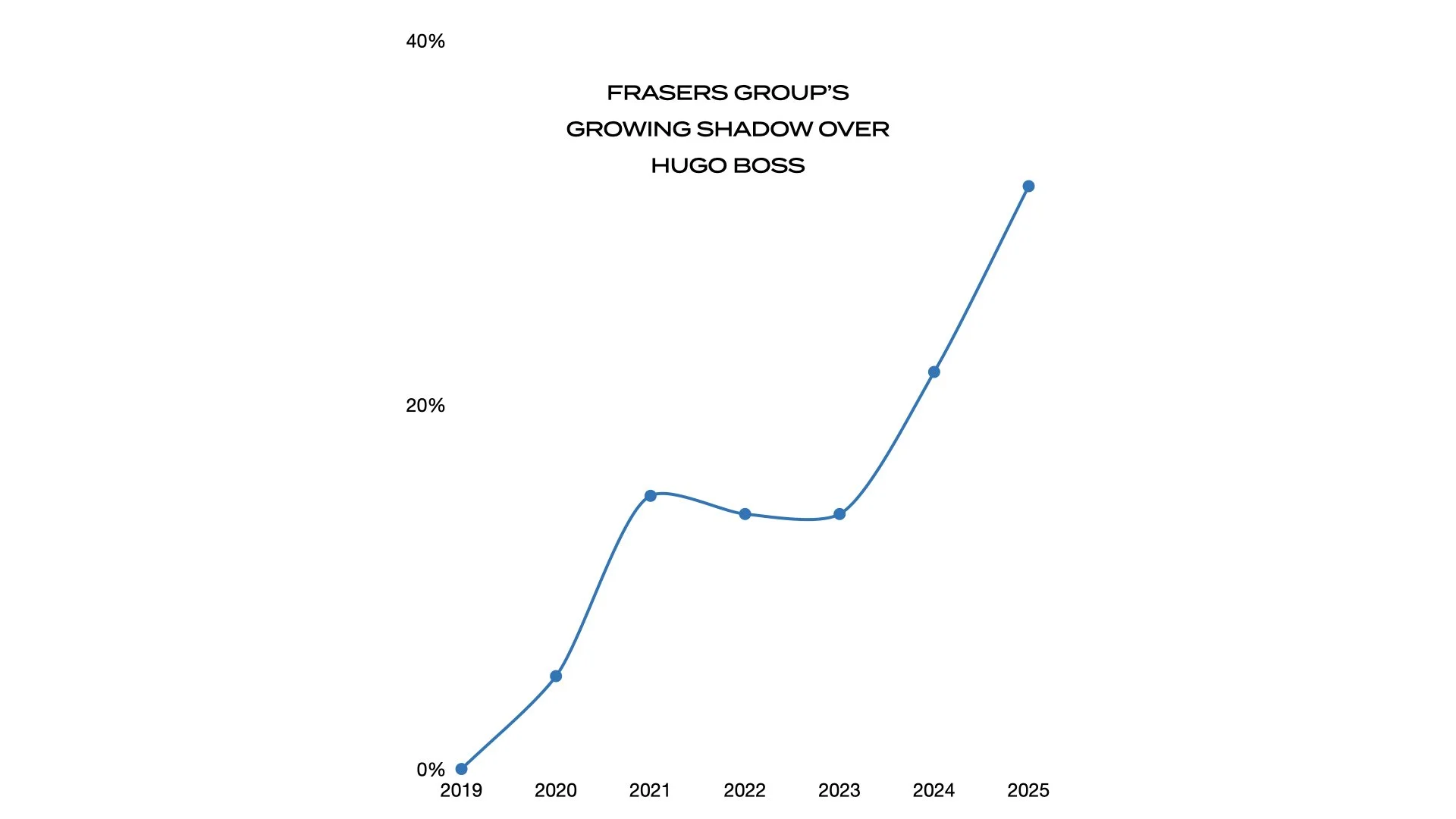

Finding 3: The Activist at the Gates

The combination of long-term neglect and executive distraction creates a predictable vulnerability. When a company is perceived to be underperforming and leaving billions in value on the table, activist investors see an opportunity. The arrival of Mike Ashley’s Frasers Group is the inevitable consequence of HUGO BOSS’s multi-billion-euro blind spots.

From 2020, the same time as HUGO BOSS announced Daniel Grieder’s arrival, through to today, Frasers Group has quietly amassed a colossal 28.20% of the company's voting rights, culminating in the 2025 election of its CEO, Michael Murray, to the Supervisory Board.

Their influence is already being exerted

Frasers Group has publicly stated it will vote against dividend payments, demanding that the board instead reinvest the capital to improve the quality of its growth. This activist stance, which also includes calls to redeem treasury shares, is a clear signal of their intent to force a shift in the company's capital allocation strategy. In addition, recent developments inside Frasers Group itself add a new layer of urgency to this situation. Their own CEO, Michael Murray, is expected to miss a personal £100 million bonus due to Frasers' underperforming share price. This internal pressure makes their investment in HUGO BOSS critical. Their demand for HUGO BOSS to scrap dividends and reinvest for growth is not just a strategic preference; it is a vital necessity to generate the returns they desperately need.

Sidebar: Who is Frasers Group?

Frasers Group, led by founder Mike Ashley, is a retail conglomerate known for its assertive and often-controversial business approach.

Aggressive Acquisitions:

They have a well-known history of acquiring struggling retailers at bargain prices. The question for HUGO BOSS is why they would be a target.

Activist Style:

They are famous for a hands-on management style and a willingness to engage in public corporate battles to unlock shareholder value.

'Elevation Strategy’:

Their recent expansion into the premium and luxury markets makes a brand like HUGO BOSS a prime target for their ecosystem.

Frasers Group's presence is not the cause of HUGO BOSS's problems, but rather their ultimate effect.

WHAT THE STREETLIGHT MISSED

The €1.375 Billion Irony

With the evidence of historical neglect, executive distraction, and the resulting activist pressure now established, the final step is to quantify the true value that remains hidden in the shadows.

This investigation started with a customer asking why the brand was making her feel invisible. The data confirms her feeling: the womenswear division has collapsed from a peak of over 13% of group revenue to an average of just 6.8% today.

The question is no longer “Why can’t they build it?”—they already have. The real mystery now is:

Why did they let it collapse?

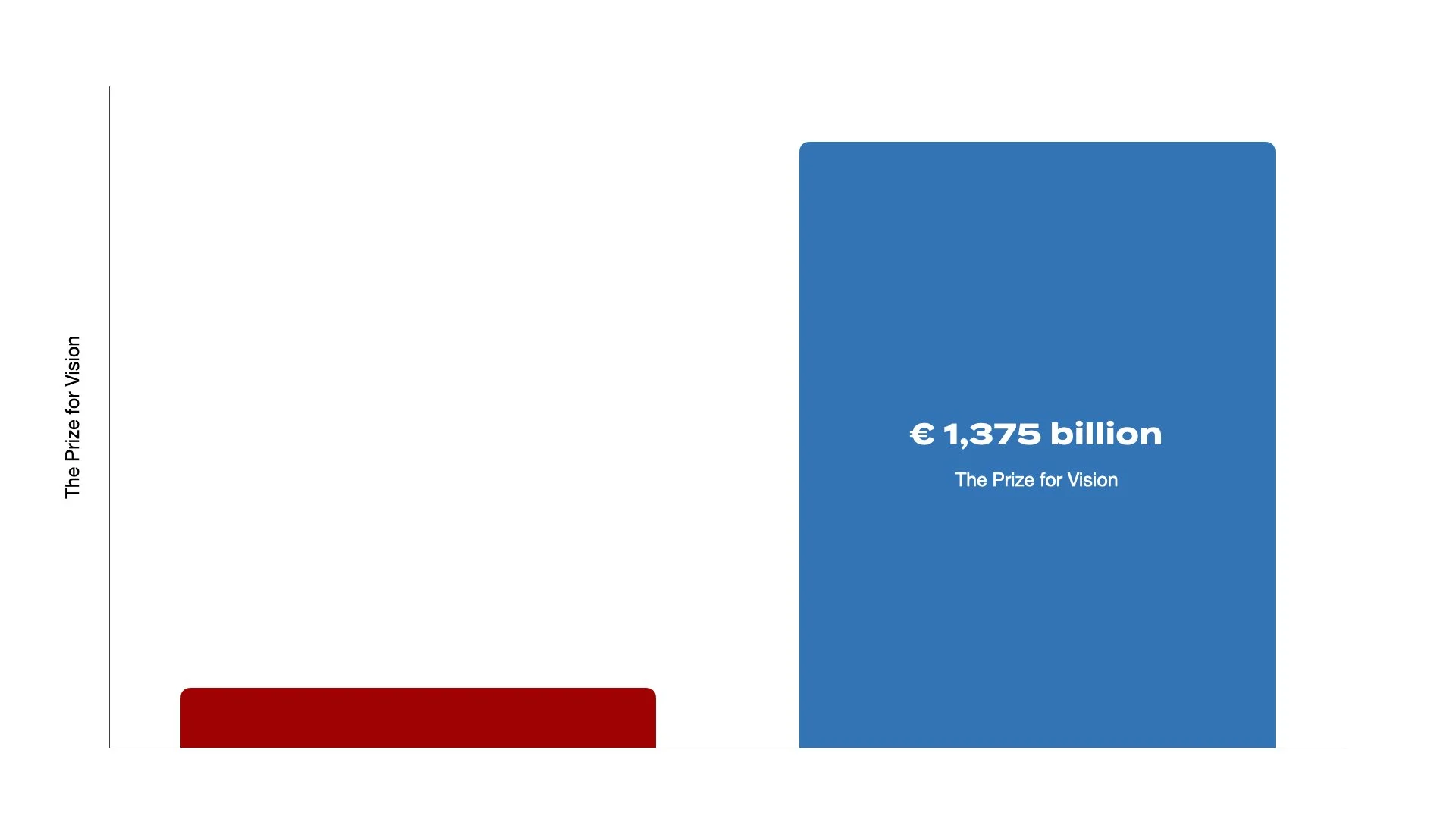

A 2025 analysis reconfirms the findings from 2017: a 60/40 gender revenue split potential continues to exist for a brand with HUGO BOSS’s market position. Closing this gap—simply by serving the customers the HUGO BOSS Streetlight is not equipped to see— would add over €1.375 billion in annual top-line revenue. This is The Prize for Vision. It is not about reclaiming a lost average but about seizing the full, forward-looking potential of the brand.

This is the ultimate irony of the Streetlight Effect. The key to smashing the €5 billion sales target and creating unassailable shareholder value was never in the bright light of the ‘CLAIM 5’ strategy playbook. It was always waiting patiently to be seen in the dark.

The €1.3 Billion Enterprise Value Prize

This dramatic improvement in profitability has a direct and profound impact on the company's total valuation. Based on the current enterprise value of approximately €4.0 billion, the operational improvements that unlock the €1.375 billion in revenue would translate directly into a potential Enterprise Value of €5.3 billion.

That €1.3 billion uplift is the ultimate prize of Diagnostic Alpha. It represents the verifiable, skill-based alpha that is created not through financial engineering, but through a surgical understanding of an asset's true operational health.

The unseen billions in revenue and margin remain in the shadows, a testament to the millions of customers who remain unseen, even after the initial signal from Dr. Kerstin Brehm was finally heard. This isn’t just about lost sales; it’s about a failure to nurture the entire ‘Customer Grove’—the allegorical term from my book for a brand’s customer ecosystem. It is a failure to tend to both the loyal ‘Fruitful Trees,’ who represent core customers, and the neglected ‘New Saplings’—the new customer segments that represent HUGO BOSS’s future.

CONCLUSION: THE KEY Is BEYOND “I DON'T BELIEVE IT”

The key to unlocking €1.375 billion in womenswear revenue for HUGO BOSS is so deceptively simple it often evokes the very disbelief that has been HUGO BOSS's response for years. The answer lies not in a complex new strategy, or even in the existing 'CLAIM 5', but in a simple, human-centric shift, once seen.

That key was revealed to me in 2017 by two fabulous ladies outside the Stuttgart store. They didn't critique the clothes they couldn't find; their question was more fundamental and profound. "Of course, we know HUGO BOSS, we know them as the masters of menswear," one said, looking toward the entrance, "but how can we buy what we cannot see?"

They were not asking for a new collection, ambassador, or icon; they were simply asking for an invitation to enter. That has always been the core and the key to reshaping the customer's gut feeling about HUGO BOSS. It is not found in expensive new marketing campaigns, new collections, or the use of ambassadors and icons. But in the profound act of a simple "invitation"—one that extends from the front window of the store to the front of the strategic agenda. That's the "I don't believe it" billion-euro key, visibility. It's about greeting the millions of customers who are already at the door, simply waiting to be seen.

The billions in hidden value wait only for a leadership team with the courage to believe that the most profound answers are often the simplest.

Unlocking this opportunity is not just a key to smashing sales targets; it is the most direct path to elevating the company's EBITDA margin to a world-class 27.3%, adding over a billion euros to its enterprise value, and closing the credibility gap with the financial markets—all while finally making Dr. Kerstin Brehm feel incredibly visible.

It’s your move, HUGO BOSS AG.

A personal sidenote

This corporate paradox, an organisation projecting health while masking critical, unseen vulnerabilities, resonates on a deeply personal level. This investigation began with a signal from Dr. Kerstin Brehm, a former cardiac surgeon. It is a fitting coincidence, as my own journey beyond the streetlight was validated by a diagnostic tool she knows well: a CT Scan.

My own "Illusion of Health" as a long-time diabetic was shattered over a decade ago when I first stepped beyond conventional wisdom's Streetlight Effect. A recent, near-perfect CAC scan result has provided the clinical objective validation for the power of that first step. I dared to look where others didn't, and that single step transformed my life.

“Always stay curious and dare to look where others don’t.”