A Precision Playbook for an Age of Diagnostic Alpha

A Surgical Upgrade for PRIVATE EQUITY Unlocking Verifiable Alpha Beyond the Streetlight Effect

A Note on Perspective

This playbook, like my book, was born from a personal journey driven by a single question: Why? For years, I received expert advice that produced results lacking verifiable answers, which led me to step beyond the comfort of the conventional Streetlight Effect and search for a truth grounded in evidence, not opinion.

I was told my path was dangerous by the same experts, reckless even. I chose to trust my own curiosity and evidence trail. For ten years, I questioned conventional wisdom, seeking a diagnostic truth. The answer came from a Coronary Artery Calcium (CAC) scan—a non-invasive CT scan designed to assess risk long before symptoms appear. The scan produced a score of 2.5%, a verifiable truth that provides a near-guarantee against a heart attack for the next decade, proving that the consensus is not always the truth. This was a result I could build upon.

This was my Rubicon. It taught me that the most valuable breakthroughs are found not by reinforcing consensus, but by having the courage to dare to look beyond the edges of the Streetlight Effect. Like the innovators and rebels celebrated for thinking differently, the greatest opportunities lie waiting just outside the established field of view, in the shadows of the unquestioned. It is a lesson in the profound power of an independent, critical-thinking perspective.

This playbook is for those leaders. It is for the innovators, investors, and visionaries across the Private Equity ecosystem who understand that true alpha is generated by seeing what others miss. It is a tool for those who are ready to embrace their own curiosity, to dare to look where others don't, and to find the profound unseen value that awaits them beyond the streetlight.

For years, I applied this diagnostic to brands worldwide. My path converged with Private Equity after a series of insights—from Professor Ludovic Phalippou's analysis in Private Equity Laid Bare to a rising chorus of insider critiques—all revealed a common theme: the industry is grappling with the very crisis of methodology I had been treating at the brand level all along—a crisis where its very perception of value has become detached from the reality of creating it.

This playbook is my answer.

Morten J. Sørensen

Managing Director and Author of Who Moved My Customers?

01 | The Executive Summary

A Crisis of Methodology

The principles of foundational diagnostics teach that any complex system—whether biological or corporate—can appear healthy while masking a deep, internal decay. Private Equity is now facing its own version of this challenge, where a reliance on malleable metrics and financial engineering has created a dangerous "Illusion of Health”.

This has fuelled a significant reputational challenge, resulting in a playbook that has reached the limits of its effectiveness. A perception of opacity now creates a gap between a firm's perceived success and the trust it commands from investors. The toolkit they have operated with, while once profitable, now creates predictable challenges:

The Debt Dilemma: The leveraged buyout (LBO) model saddles assets with debt, increasing bankruptcy risk by an estimated 18% and prioritising financial engineering over foundational strength.

The Perception of Extraction: Practices like dividend recapitalisations are often perceived as 'value extraction schemes’, impacting the 'gut feeling' of Limited Partners.

The Transparency Gap: The reliance on malleable metrics like IRR makes it impossible to differentiate genuine, skill-based alpha from simple market luck, leading to a crisis of credibility.

These are not separate issues. They are symptoms of a single, core challenge: searching for value only where the light of conventional metrics shines brightest. This reality has left the industry at a crossroads.

In this new era where diagnostic alpha is the only thing that matters, this playbook is the tool that unlocks the prize of verifiable alpha. It offers a return to the first principles of value creation, designed to solve Private Equity's own demarcation problem: to draw a clear line between skill and luck, unlocking the profound value hidden in the shadows.

02 | The Paradigm Shift

Introducing the Organisational CT Scan

The challenges outlined in the Executive Summary are not the result of a failed model, but of a flawed perspective. For too long, the industry has operated under the cognitive bias known as the “Streetlight Effect”—searching for value only where financial data is easy to see, while the real, untapped potential remains hidden in the shadows.

This approach treats every company as an “Opaque Black Box”, leaving firms to make high-stakes decisions based on an incomplete picture. This perspective comes not from within an industry that can be hesitant to question itself, but from an independent, diagnostic viewpoint focused solely on one metric: documented, quantified value creation that benefits the asset directly.

To generate true, sustainable alpha requires a fundamental paradigm shift: moving from superficial observation to deep diagnosis. This new approach is built on a single, guiding principle:

“VIRTUALLY ANYTHING THAT HAS AN EFFECT CAN BE OBSERVED, AND ITS IMPACT UNDERSTOOD, EVEN IF NOT WITH OLD RULERS.”

To act on this principle, a new kind of ruler is required. The Organisational CT Scan is a proprietary diagnostic methodology designed to illuminate an asset’s Opaque Black Box. It provides a non-invasive, evidence-based way to see inside virtually any asset, measure its true operational health, and quantify the financial impact of its customer disconnects.

This diagnostic approach forms the foundation of a new, high-precision playbook designed for the modern economy. This is not a single snapshot, but a multi-layered diagnostic capable of revealing different truths—from customer base synergies in an M&A scenario to hidden operational frictions within a single asset—depending on the challenge at hand.

03 | The 5-Step Precision Playbook

The following five steps provide a clear, actionable roadmap for PE firms to navigate today's challenges. This playbook moves beyond generic financial engineering to a surgical approach focused on diagnosing issues, unlocking hidden value, and proving verifiable alpha.

Step 1: De-Risk the Debt-Fuelled Acquisition

The Challenge

The leveraged buyout (LBO) model, a cornerstone of the PE industry, is creaking under its own weight. In a typical buyout, loans are put in the name of the purchased company, saddling the asset with hefty debt from day one. This practice contributes to a significantly higher bankruptcy risk, with studies indicating it is 18% higher after a leveraged buyout. Conventional due diligence, which focuses on visible financial data, often overlooks the hidden operational dysfunctions that could jeopardise the investment.

The Upgrade: Deploy the Organisational CT Scan Before You Sign

Instead of buying a problem, you acquire a solution. A pre-acquisition scan provides a deep, proprietary diagnostic of an asset's true operational health and integrity. This allows you to:

De-Risk the Debt: The scan meticulously exposes hidden risks and quantifies previously unseen inefficiencies before you commit capital. This ensures your debt load is based on a robust valuation of the asset's true potential, not just its visible shell.

Build an Evidence-Based Roadmap: Armed with a verifiable understanding of the asset's health, you transform operational risk into a de-risked, actionable plan for value creation from day one.

Step 2: Uncover Value BEYOND THE SATURATED MARKET

THE PERCEIVED CHALLENGE

The days of finding undervalued companies with obvious "fat to trim" are largely over. Intense competition has led to a situation where there are record amounts of uninvested cash ("dry powder") because it's getting "harder and harder to find those companies" with clear potential for improvement. Many sectors have already received the "PE treatment", leaving traditional playbooks with few levers to pull beyond further financial engineering.

THE HIDDEN OPPORTUNITY

The challenge isn't a lack of opportunity, but a lack of precision tools to see it in a competitive market. A firm that can look beyond the streetlight doesn't just compete—it dominates. This is how you gain the upper hand:

Find Obscured Value: The Organisational CT Scan is designed to uncover the profound potential that traditional due diligence is blind to. My case files prove that over €30 billion in untapped revenue can be hidden in plain sight—concealed by a single linguistic word on a product label or an efficient internal keystroke.

Transform Your Deal Flow: Instead of fighting over the same obvious assets, you gain the ability to see a landscape rich with undervalued opportunities. This transforms your role from a market participant subject to intense competition to a precision architect of value with a distinct, reputational, and sustainable advantage.

Step 3: SHIFT FROM VALUE EXTRACTION TO SUSTAINABLE VALUE CREATION

The Challenge

High fees are often generated not just from successful exits, but from practices that, while designed to generate returns, can be perceived as 'value extraction schemes' that risk a company's long-term health. The consequences of a purely financial focus can be severe, particularly in sensitive sectors like healthcare, where studies have noted negative patient outcomes in some PE-owned facilities.

The Upgrade

Move from emergency surgery to a preventative stent that builds organisational health. A broad-stroke financial approach can be like waiting for a patient to show acute symptoms before intervening with high-risk surgery. A modern, high-precision playbook focuses on diagnosing issues and restoring Organisational Health before a crisis. This approach is more efficient and effective, as it targets specific needs. It is achieved by:

Diagnosing Before You Cut: The Organisational CT Scan acts as a cardiac CT scan, non-invasively finding the specific "plaque"—the customer disconnects and hidden inefficiencies—that are silently clogging the arteries of the business.

Applying Surgical Precision: By pinpointing the precise nature and location of the problem, you can apply a targeted "stent"—a minimally invasive operational fix that restores healthy value flow. This approach builds a stronger, more resilient company by protecting its culture of innovation and strengthening customer loyalty—the very assets that drive long-term enterprise value.

Step 4: Shatter the "Illusion of Health" with Verifiable Metrics

The Challenge

The Private Equity industry's reputation for opacity is well-earned. For decades, firms have used performance charts that experts now suggest can be "phoney" and based on "highly convenient benchmarks". The key metric, the Internal Rate of Return (IRR), is susceptible to manipulation, which can create a reassuring but misleading Illusion of Health while the value of unsold assets is overly optimistic. This lack of transparency makes it impossible to differentiate genuine skill from simple market luck.

THE UPGRADE: WEAPONISE YOUR TRANSPARENCY

Instead of hiding behind opaque, easily manipulated numbers, a high-precision playbook leads with verifiable proof of genuine value creation. This is achieved through two proprietary metrics derived directly from the Organisational CT Scan:

Quantify the Unseen: The Asset Efficiency Score (AES) is a proprietary metric that provides a true measure of an asset's operational health. It moves beyond sentiment and opinion to quantify unrealised potential in concrete monetary terms, representing the value being lost due to internal frictions and causal customer disconnects. It provides a verifiable, data-driven baseline for performance that cannot be easily manipulated.

Certify Your Success: The Asset Efficiency Certification (AEC) is the ultimate proof of performance. It provides transparent, third-party validation that tracks an asset's AES improvement over the investment lifecycle (3-7 years). By documenting long-term, quantified improvements in operational effectiveness, the AEC empowers General Partners to demonstrate genuine, skill-based alpha over simple market luck irrefutably to their Limited Partners (LPs) and other stakeholders.

Step 5: Engineer a Credible Exit Strategy

The Challenge

The traditional exit often relies on pure market mechanics. A common goal is to take a company public via an IPO and secure its inclusion in a major index like the S&P 500. This is a powerful strategy because it can create a pool of "forced buyers" (like index funds and pension funds) who must purchase the stock, which can boost a valuation based on market mechanics, sometimes independent of the company's underlying operational health. This dynamic can reinforce a narrative that PE prioritises financial engineering over building fundamentally sound companies.

THE UPGRADE: BUILD A LEGACY OF INDISPUTABLE VALUE

A high-precision playbook doesn't just rely on market timing; it engineers a narrative of genuine strength that builds long-term credibility and maximises value based on verifiable proof. This is accomplished by:

Exiting with Proof: Instead of just bringing a good story to the market, you bring a certified, healthy asset. The Asset Efficiency Certification (AEC) provides profound, verifiable assurance to future buyers, LPs, and the public market that they are acquiring a resilient, high-performing company with a proven track record of operational excellence.

Controlling the Narrative: Armed with a certified asset and data-backed success stories, your conversation with the market is no longer defensive. It's a proactive demonstration of excellence that allows you to build a powerful reputation as a credible architect of genuine market growth, transforming your firm's image from a financier to a proven builder of resilient companies.

04 | The Diagnostic Alpha Framework

A 3-Phase Framework

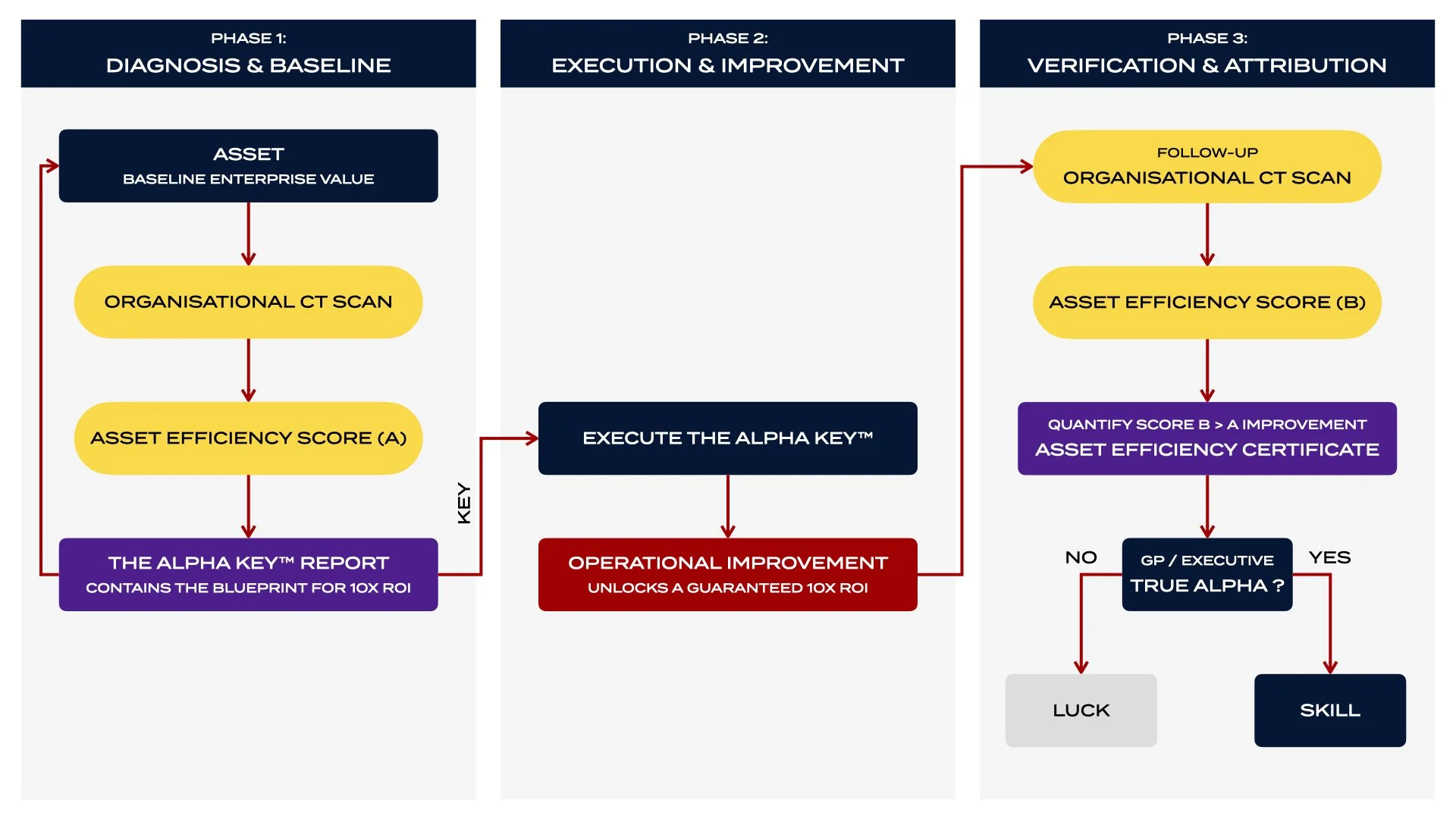

While the 5-Step Playbook outlines when and why to apply a diagnostic mindset across the investment lifecycle, this chapter details the operational engine that powers the entire process. This 3-phase framework is the systematic methodology for moving any asset from an "Opaque Black Box" to a source of verifiable, skill-based alpha. It is the engine that drives the shift from superficial observation to deep diagnosis, unlocking profound value hidden beyond the Streetlight Effect.

Phase 1: Diagnosis & Baseline

The first phase is a non-invasive, evidence-based process designed to establish a verifiable truth about an asset's current operational health.

Organisational CT Scan: This proprietary diagnostic moves beyond surface-level metrics to see inside an asset's true operational state. It synthesises a wide array of inputs—from financial data and internal processes to qualitative customer sentiment—to illuminate the hidden frictions and disconnects that erode value.

Asset Efficiency Score (AES): From the scan, we derive the Asset Efficiency Score (AES), a proprietary metric that quantifies the value being lost due to these disconnects. It provides a single, data-driven baseline (Score A) of the asset's health. A lower score signifies a larger, untapped opportunity for improvement.

The Alpha Key™ Report: The findings are delivered in this report, which contains the blueprint for achieving a minimum 10X ROI. It provides a single, high-impact, and evidence-based Alpha Key™ that targets the root cause of the asset's inefficiency.

Phase 2: Execution & Improvement

This phase is about surgical action. It translates the diagnostic insight from Phase 1 into a targeted, high-impact operational intervention.

Execute the Alpha Key™: This step involves the precise implementation of the single, transformative insight delivered in the report. It is the catalyst for moving the asset from its organisational homeostasis baseline toward a state of optimal performance.

Operational Improvement: The result is a targeted operational improvement that directly addresses the identified customer disconnect. This is the phase where the guaranteed 10X ROI is unlocked, transforming the diagnostic blueprint into realised, tangible value.

Phase 3: Verification & Attribution

The final phase provides irrefutable proof that the intervention was successful and that the value created was the result of skill, not luck.

Follow-up Scan & Score (B): A second Organisational CT Scan is conducted post-implementation to produce a new, updated Asset Efficiency Score (B).

Quantify Improvement (B > A): Verifiable improvement is demonstrated when the new score (B) is greater than the baseline score (A). This quantified, positive change is memorialised in the Asset Efficiency Certificate, providing transparent, third-party validation of the improvement.

GP / Executive True Alpha: By documenting a direct, causal link between the targeted intervention (Phase 2) and the data-driven improvement in operational effectiveness (Phase 3), the framework provides definitive proof of performance. It empowers General Partners and Executives to irrefutably demonstrate genuine, skill-based alpha over simple market luck to LPs and all other stakeholders.

05 | A Case Study in Precision

The principles in this playbook are not theoretical. The following case study demonstrates one powerful application of this diagnostic process, designed to uncover profound, quantifiable value where others see nothing.

Unlocking €1.375 Billion in the Shadows

HUGO BOSS

1. Following the Scent Beyond the Streetlight

My investigation did not begin with a financial statement, but with a human signal—a faint scent of customer disconnect that traditional analysis always misses. Dr. Kerstin Brehm, a former cardiac surgeon and the brand's ideal customer, posted publicly about her lifelong loyalty, yet current feeling of being a "stylish afterthought." Her question was profound and one I wanted to answer:

“Why was a brand she loved making her feel invisible?”

This is the starting point for the Strategic Bloodhound: a signal from the shadows that demands investigation.

2. The Visual Diagnosis of the Problem

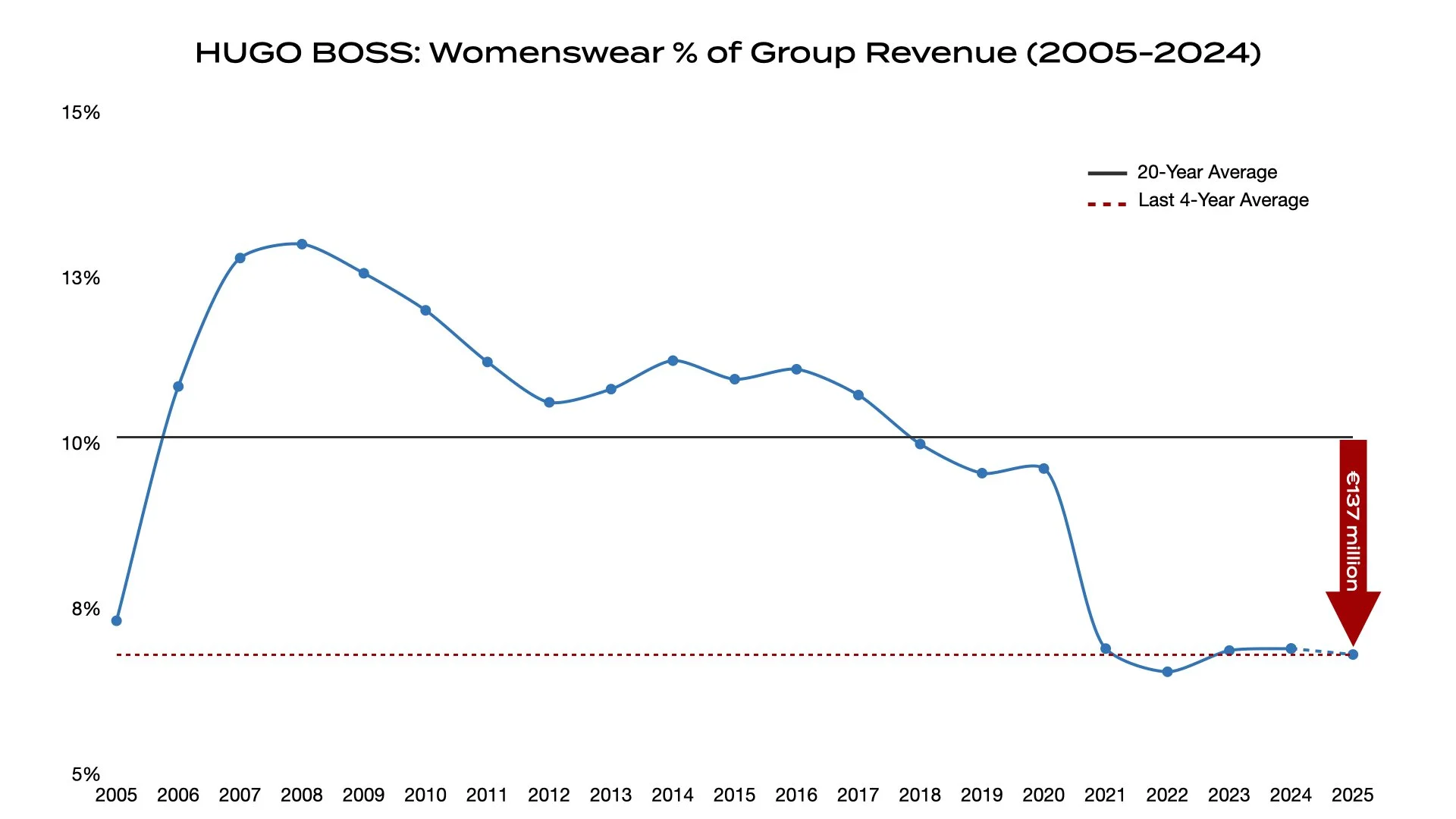

The first step was to determine if Dr. Brehm's “feeling” was an emotion or a quantifiable reality. The Organisational CT Scan began by analysing two decades of HUGO BOSS's own financial data. The result was unequivocal.

The chart below visualises the problem. After peaking at over 13% of group revenue, the Womenswear division collapsed, falling to an average of just 6.8% over the last four years. This gap between the 20-year historical average and current performance represents €137 million in missed annual revenue. I call this The Cost of Decay—the annual price a company pays for simply failing to maintain its own established baseline. While this data provided the verifiable truth of what was happening, it could not answer the most important question: Why?

Diagnosis vs. Disbelief: Quantifying the Prize for Vision

While the problem was clear, HUGO BOSS was operating under its own Streetlight Effect. The company's focus was on the bright light of its 'CLAIM 5' strategy, which had driven record top-line revenue. However, sophisticated investors were sceptical, noting a depressed share price that contradicted the celebratory narrative.

They sensed what my Organisational CT Scan would prove: the Illusion of Health was masking a massive, unaddressed vulnerability.

3. Unlocking the Opaque Black Box

The diagnostician in me revealed the disease: a systemic failure to see, value, and serve its female customers. This was the same verifiable truth I had presented to the company myself in reports from 2017, 2019, and 2021. My follow-up conversations with Dr. Brehm confirmed that HUGO BOSS leadership had been presented with these conclusions from multiple sources. The response was consistently a variation of "I don't believe it"—a classic symptom of a leadership team insulated from reality by their own success.

The core disconnects weren't about hemlines or handbags; they were about a fundamental lack of visibility and invitation. As two customers outside the Stuttgart store told me, "How can we buy what we cannot see?”

4. The Verifiable Alpha Opportunity

The true power of this playbook is not just in diagnosing problems, but in quantifying the prize for solving them. A 2025 re-analysis confirmed that a 60/40 gender revenue split is a realistic potential for HUGO BOSS. Closing this gap would add over €1,375 billion in annual top-line revenue.

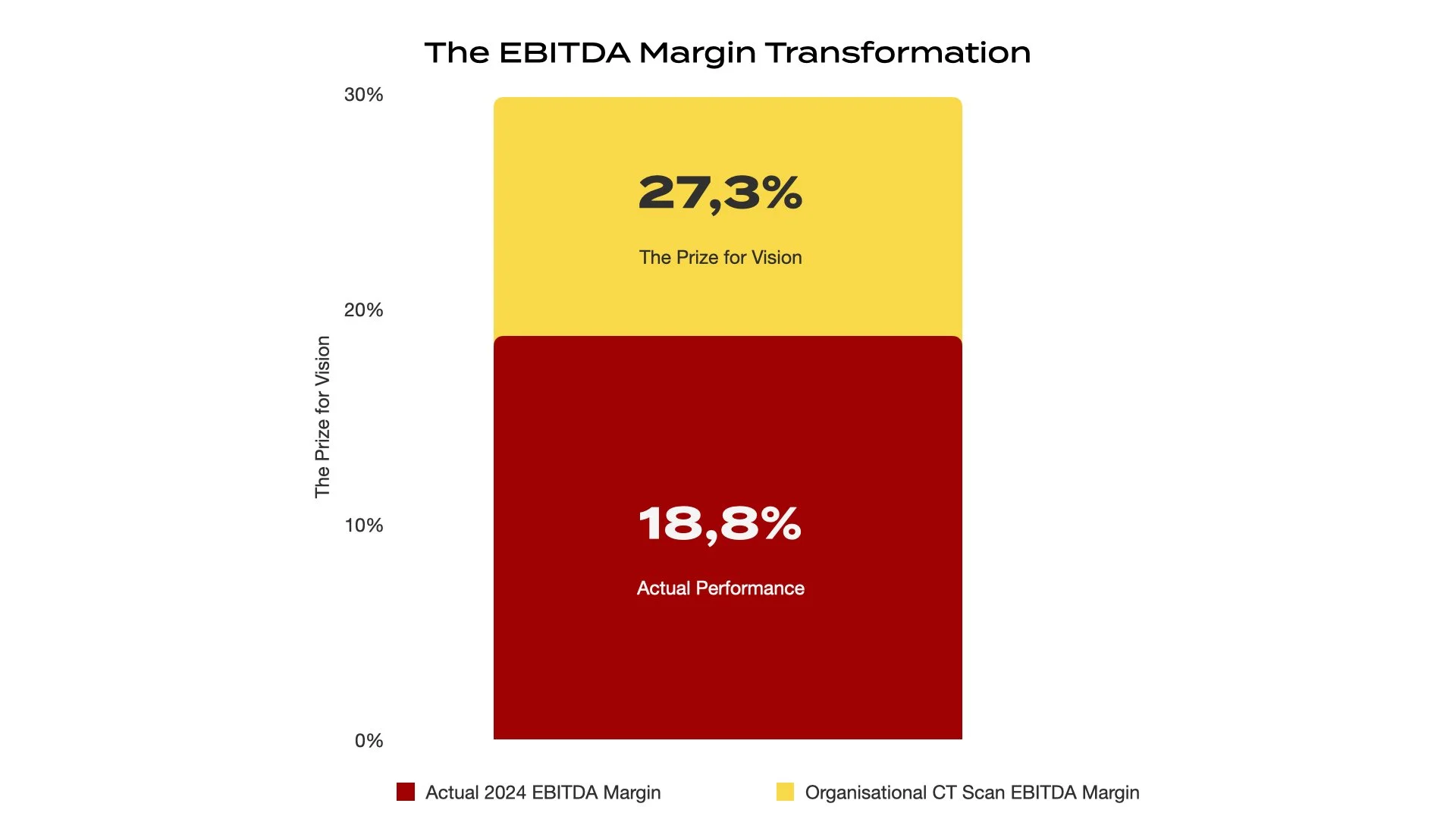

This is The Prize for Vision—the verifiable alpha waiting in the shadows. But for a Private Equity owner, the ultimate prize is how this top-line opportunity translates into the language of their world: EBITDA margin.

5. THE EBITDA PAYOFF: THE PRIVATE EQUITY PERSPECTIVE

For a PE owner, the true prize isn't just top-line revenue; it's the explosive impact on the bottom line. In 2024, HUGO BOSS delivered an EBITDA margin of 18.8%.

A hypothetical analysis shows that by capturing the €1.375 billion opportunity in womenswear, that margin would have catapulted to a world-class 27.3%. That nearly 900-basis-point improvement—a 1.5x multiple on the asset's core profitability—is the definitive proof of value creation: the high-octane fuel required to comfortably service LBO debt and dramatically increase enterprise value at exit.

This case study is the high-precision playbook in action. It demonstrates how starting with a faint human signal leads to a deep diagnosis that unlocks a multi-billion-euro opportunity—one that was always there, waiting patiently to be seen. The key to unlocking this value is now in their hands, but as this investigation proves, you cannot give billions in revenue to a leadership team that refuses to believe it exists just beyond their own Streetlight Effect.

The Enterprise Value Transformation

Translated into the ultimate PE metric, this margin improvement would increase HUGO BOSS’s Enterprise Value from approximately €4,0 billion to €5,3 billion. That 30% uplift—a 1.3x increase in Enterprise Value derived purely from a diagnostic insight—is the definitive, verifiable prize of Diagnostic Alpha.

06 | Putting the Precision Playbook to Work

The playbook provides a verifiable, data-driven standard for the Private Equity ecosystem, replacing opacity with clarity and market luck with provable skill.

1. For General Partners (GPs) & PE Firms

Source Smarter: Uncover immense value in assets that competitors, blinded by conventional metrics, will overlook.

De-Risk Acquisitions: Justify valuations and make investment decisions based on a deep, diagnostic understanding of an asset’s true operational health.

Accelerate Fundraising: Provide LPs with certified, verifiable proof of skill-based alpha, moving beyond opaque and malleable metrics.

2. For Limited Partners (LPs) & Investors

Look Inside the Black Box: Ask sharper, more insightful questions about how a GP truly plans to generate returns beyond financial engineering.

Verify the Alpha: Request verifiable proof of operational effectiveness, like an Asset Efficiency Certification (AEC), to identify elite managers who can deliver genuine alpha.

Drive Sustainable Growth: Champion a model that builds healthier, more resilient companies, better aligning financial returns with long-term performance.

3. For Consultants & Service Providers

Deliver Unique Insight: Provide your PE industry clients with a unique, data-driven diagnostic that uncovers profound new opportunities for value creation.

Differentiate Your Practice: Set your firm apart by offering a proprietary, verifiable methodology that elevates your strategic recommendations, builds undeniable credibility, and justifies premium fees.

Speak the Language of Verifiable Alpha: Align your services directly with your clients’ ultimate goal: delivering provable, skill-based returns to their investors.

In this new era where Diagnostic Alpha is the only thing that matters, this playbook is the tool that unlocks the prize of Verifiable Alpha.

Continue the Journey Beyond the Streetlight

This playbook was created for the innovators, investors, and visionaries ready to find value where others don't. For those prepared to apply these principles, here are the resources to guide your next steps.

Your Resources

For Deeper Insight: To explore the allegorical story and philosophy behind the "Streetlight Effect," the book Who Moved My Customers? provides the foundational mindset for this new diagnostic approach is available on Amazon or here.

For Actionable Application: For a confidential discussion on applying the Organisational CT Scan to a specific portfolio asset or pre-acquisition target, you can connect with Morten directly. This is the path from theory to verifiable alpha.

For Ongoing Dialogue: To engage with current analysis, case studies, and join the conversation with other leaders, follow the latest insights on LinkedIn.