The face of a £100m opportunity lost

She lent me her foot, but they’d lost their sole. The Russell & Bromley tragedy.

A week ago, my wife Victoria asked me, “Can you save Russell & Bromley?”

She’d read the 153-year-old family business was in trouble, a scenario I’d handled with another Italian luxury brand eight years ago.

My wife loves Russell & Bromley. I love my wife. So, I said, “Of course.”

Last year in London, I’d bought Victoria two pairs of trainers. Living in Europe, returns are impossible. The staff were impeccable. One assistant even lent me her bare feet to model the fit—a flawless service. So, why the crisis?

Too late. Russell & Bromley has been sold pre-pack to NEXT PLC. Only the IP and three stores are saved; the rest liquidated.

The price? £2.5 million.

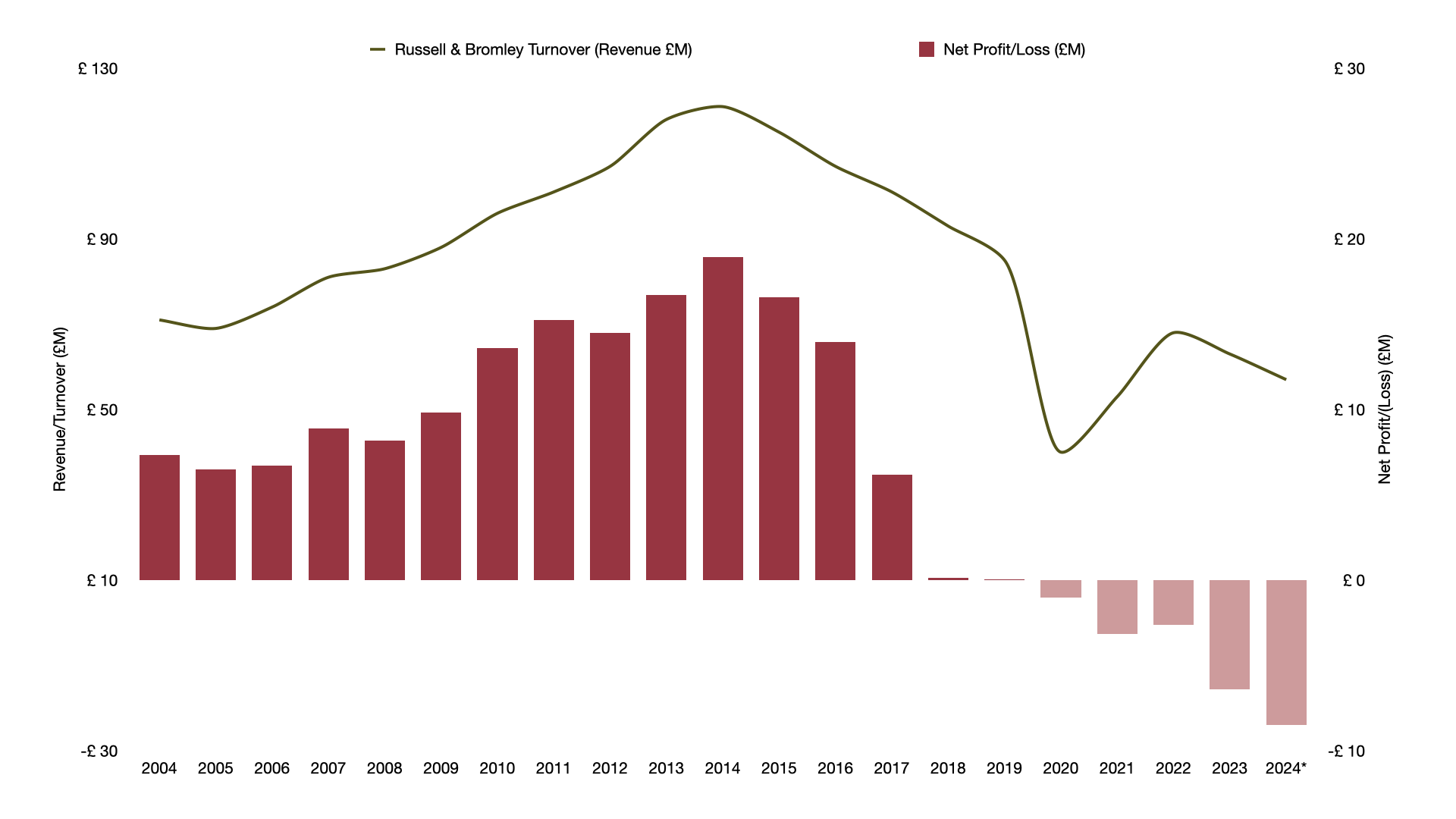

A brand with a £120M turnover in 2014, sold for the price of a small London townhouse today. Confusing.

The Historical Reality Check

Russell & Bromley was established in 1873. For 153 years, it survived two World Wars, the Great Depression, and every recession in between. It was resilient. It was anti-fragile.

But by 2019, everything changed.

The financial signs showed fortunes changed overnight. Net worth dropped. Liabilities exploded. An Organisational CT Scan revealed that in just 7 years—less than 5% of its entire history—the business was hollowed out.

This was the Opaque Black Box in action: the board was looking at margin protection (the Streetlight), while the customer was experiencing the erosion of the brand's sole (the Shadow).

The Diagnosis

What broke a heritage company that survived for five generations? Appeasement.

“To see the invisible, we simply need new rulers.”

Leadership stopped fighting for the product and appeased the spreadsheet. To protect margins, they engaged in “Value Engineering”—swapping heritage materials for cheaper substitutes. Inexcusable.

They traded 153 years of trust for short-term margin protection, triggering a Corporate Doom Loop: lower quality reduced customer loyalty, which led to further cuts and accelerated decline.

The core problem: leadership chose appeasement over maintaining the brand’s luxury heritage.

The Verdict

The staff sold the legacy; the last 7-year strategy broke it. Burning ~£82M in equity and debt over five years merely flatlined the business. They were stuck in Organisational Homeostasis—working hard to maintain a broken equilibrium.

A tragedy for the family, but the value remains. My audit confirms a clear path to a £100m+ Enterprise Value—a 40x ROI waiting for the new owner—if they use the keys to unlock the "Black Box". The family didn't. They sold for a fraction of inventory value.

A Diagnostician’s Perspective

The most expensive sentence in business is, “I don’t believe it.”

Heritage offers no protection from reality. Appeasement does not ensure survival. Leaders must address root causes decisively—before contagion takes hold and others decide the outcome for you.

To the staff—especially the one who lent me her foot—my respectful sympathies. You deserved better than the product you were given to sell.

Baby, I’m sorry I couldn’t save Russell & Bromley in time.