PRIVATE EQUITY FIRMS: Is Your LBO Model a Ticking Time Bomb Trapping You in Quicksand?

The alarming reality facing Private Equity firms today echoes a stark warning from Moody’s, as highlighted in the Financial Times: LBO models are under increasing pressure from the “hefty debt loads” of their leveraged portfolio companies. Rising interest rates deepen the debt servicing burden, putting additional strain on financial health and significantly increasing the likelihood of bankruptcy. The numbers are grim: approximately 20% of large companies acquired through LBOs typically go bankrupt within ten years. With current rate increases, it’s easy to foresee bankruptcy rates moving towards one in three in the coming years. That’s the problem—a veritable ticking time bomb threatening to pull valuable assets into quicksand.

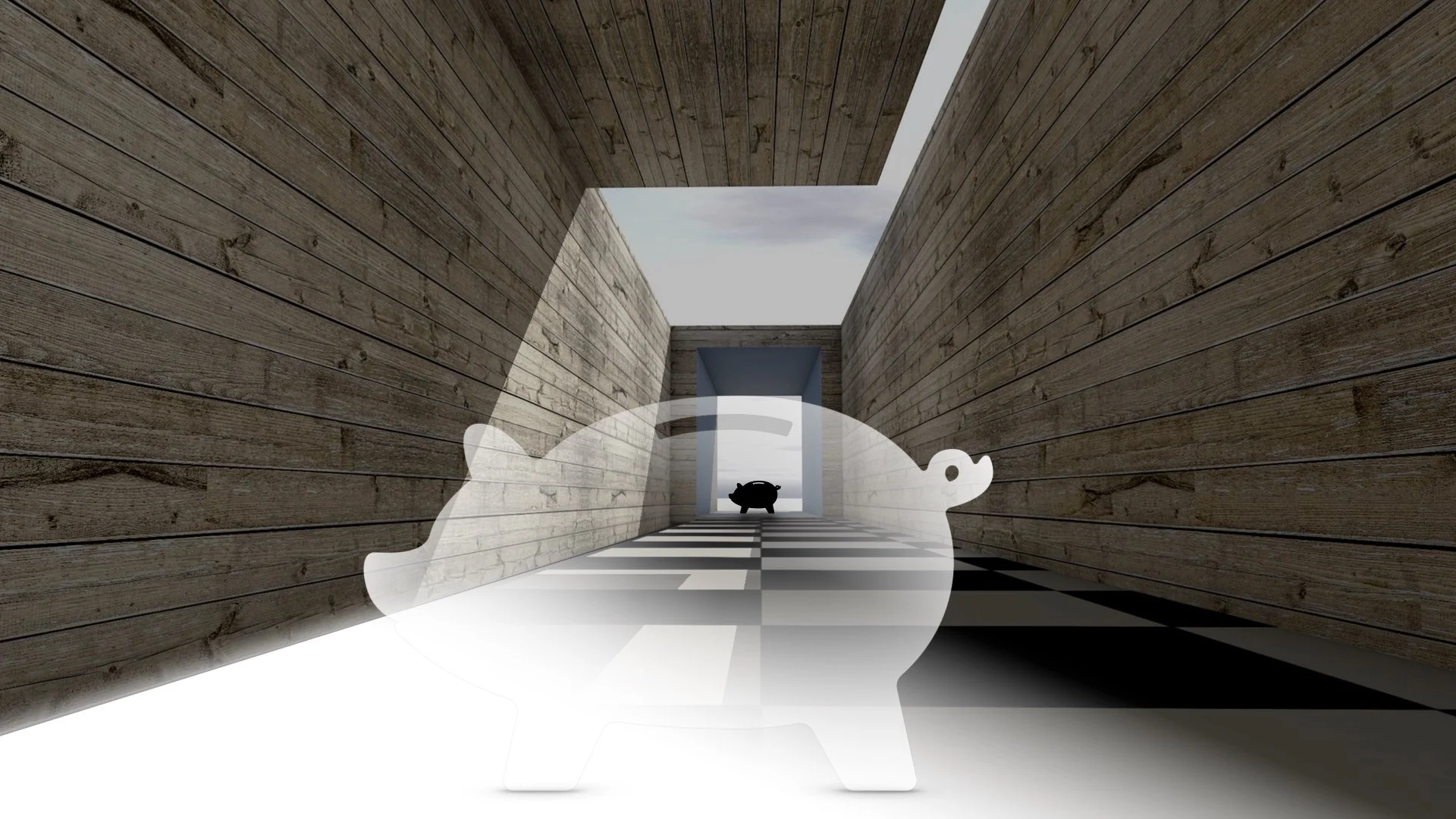

But why, even with sophisticated LBO models and rigorous initial due diligence, does this happen? The issue often lies beyond the visible numbers, in the Opaque Black Box of unseen operational inefficiencies and deep-seated customer emotions and disconnects that erode value from within, making assets profoundly vulnerable to external pressures. This is the Streetlight Effect in play: focusing intently on the financial structure while overlooking the critical truths lurking in the operational shadows.

Yes, the situation may seem critical, but a powerful lifeline is available. Leveraging the Organisational CT Scan helps Private Equity firms and their portfolio companies stave off bankruptcy and generate significantly higher returns for their investors and shareholders.

My business model is as transparent as my insights. No win, no fee. It operates alongside a familiar “two and twenty” fee structure: a 2% hidden value finders fee with a 20% performance fee paid on the revenue pathways illuminated that generates a quantified metric. Your unseen success is also mine.

The proprietary Organisational CT Scan diagnostic assessment maximises your NAVs and assets’ profits, increasing management fees and carried interest. It strengthens your asset(s)/fund(s) performances to become industry-leading and dominant. The Organisational CT Scan’s proven accuracy has successfully unlocked over €3.5 billion in incremental annual systematic revenue, generating over €30 billion in total client value since 2015.

Like legendary designer Paula Scher at NYC design agency Pentagram, who famously sketched the iconic Citi logo on a napkin, earning $1.5 million in five minutes from a $2.3 trillion asset. My Strategic Bloodhound instincts have been honed over five decades, born from a life-changing journey of seeing what others miss.

Today, I instinctively see organisations’ hidden billions, and importantly, I can also illuminate the unseen pathways to higher returns for your Assets Under Management (AUMs). That is the power of the Organisational CT Scan, providing Asset Efficiency Score (AES) insights in due diligence and ongoing portfolio oversight, tracked over an asset’s lifecycle to reveal your Asset Efficiency Certificate (AEC). Revealing your team’s Value Creation Plan (VCP) as a skill or a matter of luck.

Let’s get together. I work and teach leaders, executives, and private equity professionals to unlock true alpha by illuminating unseen forces and transforming overlooked details into verifiable results. Sometimes, the best way to trigger change is to dare to see what others don’t.