Image 1 of 5

Image 1 of 5

Image 2 of 5

Image 2 of 5

Image 3 of 5

Image 3 of 5

Image 4 of 5

Image 4 of 5

Image 5 of 5

Image 5 of 5

The Alpha Key™ Audit – VINTED Group

An Asymmetric Investment Opportunity.

This 35-page report is a restricted-access forensic audit designed for Institutional Investors, Private Equity Partners, and Vinted Group Executive Leadership.

It creates a verifiable bridge between Vinted’s current €5 Billion valuation and a projected €10 Billion Decacorn Exit.

For an acquisition investment of €330,000, you are securing the architectural blueprint to capture €4.92 Billion in latent enterprise value. This document is not “market research”; it is a shovel-ready execution roadmap that creates immediate, compoundable equity.

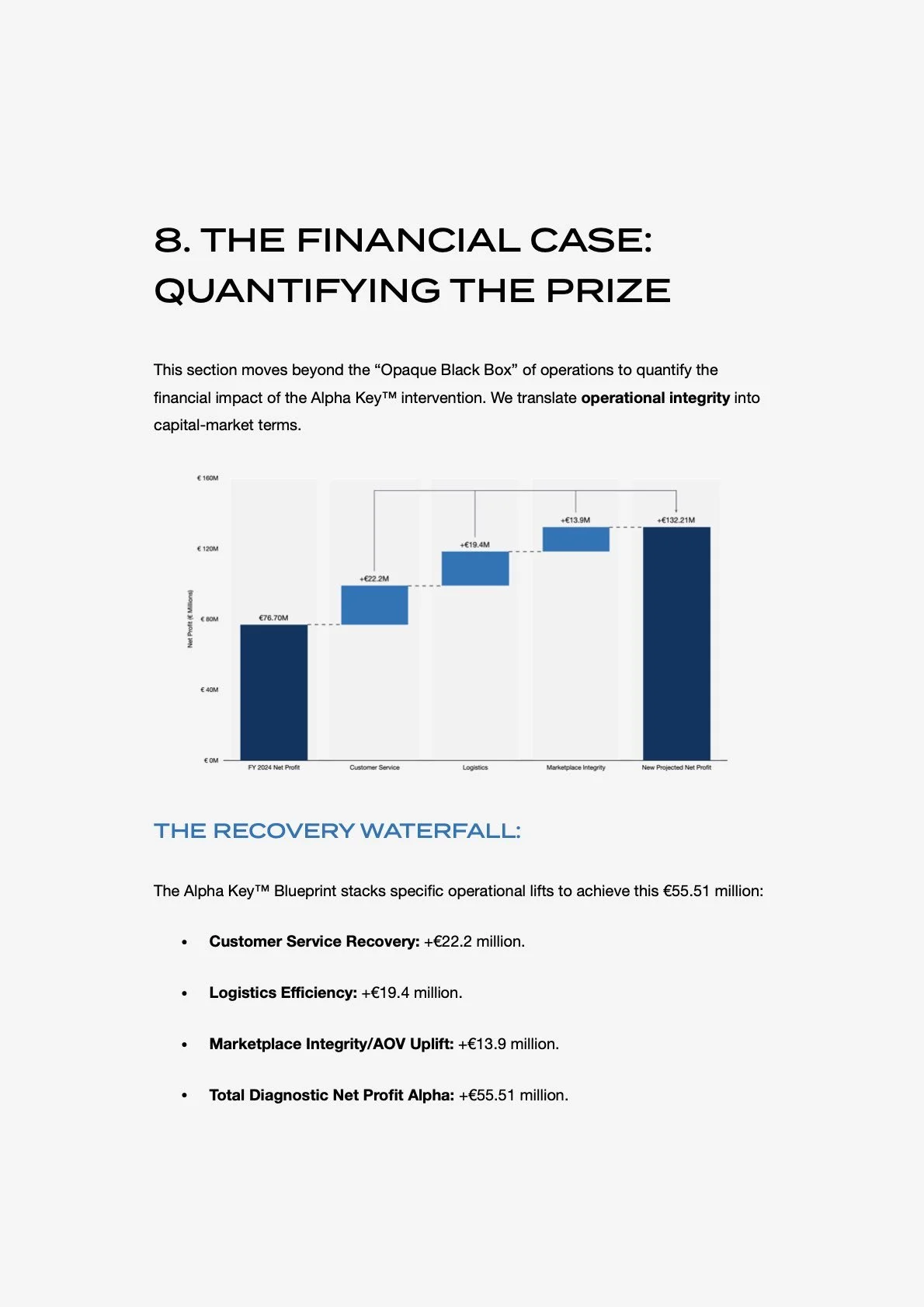

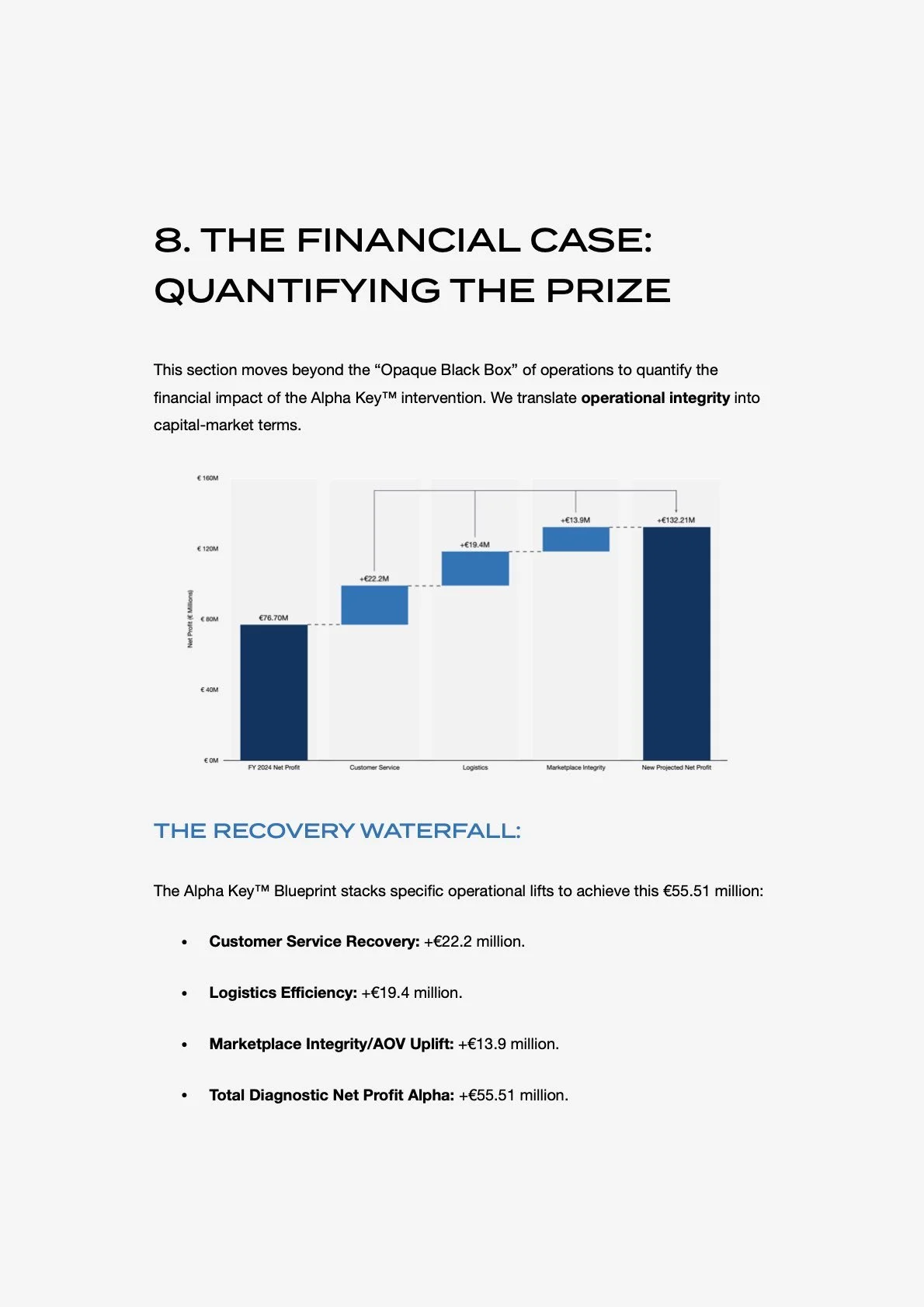

The Financial Logic

The price of this asset is mathematically derived from its minimum guaranteed output:

The Upside: €4.92 Billion in Total Enterprise Value Uplift.

The Cost: €330,000.

The Arbitrage: Your investment is 0.006% of the identified value potential to secure the roadmap.

The 10X Contractual Guarantee

We do not sell theory. We sell outcomes. The purchase of this audit includes a binding 10X ROI Performance Guarantee. If the implementation of the “Alpha Key Protocols” (Seller Shield, Resolution Pivot, Integrity Fortress) does not generate a verified minimum of €3.300.000 in new operational value, the difference will be credited via performance-based advisory services. (See Section 10 of the Audit for full covenant details.)

Forensic Scope

This 35-page strategic dossier performs an “Organisational CT Scan” on Vinted’s operational infrastructure, revealing a “Schrödinger’s Cat” paradox: highly efficient financials masking deep systemic decay in the customer asset.

The report delivers three proprietary assets:

The Diagnostic Data: A granular calculation of the Asset Inefficiency Score (AIS: 54.6%), pinpointing exactly where €444.12M in annual revenue is leaking.

The Execution Protocols: A surgical, step-by-step operational restructuring plan to reduce returns velocity by 48%and stabilise the user base.

The Alpha Vault (B2B Engine): The complete business case for “Vinted Services”—a strategy to monetise Vinted’s inventory data into a recurring revenue stream targeting the €138B Global Insights market.

Target Acquirer Profile

Private Equity & Deal Teams: Use this as your Pre-Bid Operational Due Diligence. Identify the exact levers to pull post-acquisition to double the multiple.

Vinted Board & C-Suite: This is your Defense Strategy against a down-round or post-IPO correction. Secure the narrative and the numbers before the roadshow.

Conglomerates: Acquire the blueprint for the secondary market data ecosystem before your competitors do.

Asset Specifications

Report: Subject to local applicable taxes.

Format: Digital Dossier (PDF).

Clearance: Restricted to Accredited Investors and Corporate Entities.

Delivery: Instant Secure Transfer upon remittance.

An Asymmetric Investment Opportunity.

This 35-page report is a restricted-access forensic audit designed for Institutional Investors, Private Equity Partners, and Vinted Group Executive Leadership.

It creates a verifiable bridge between Vinted’s current €5 Billion valuation and a projected €10 Billion Decacorn Exit.

For an acquisition investment of €330,000, you are securing the architectural blueprint to capture €4.92 Billion in latent enterprise value. This document is not “market research”; it is a shovel-ready execution roadmap that creates immediate, compoundable equity.

The Financial Logic

The price of this asset is mathematically derived from its minimum guaranteed output:

The Upside: €4.92 Billion in Total Enterprise Value Uplift.

The Cost: €330,000.

The Arbitrage: Your investment is 0.006% of the identified value potential to secure the roadmap.

The 10X Contractual Guarantee

We do not sell theory. We sell outcomes. The purchase of this audit includes a binding 10X ROI Performance Guarantee. If the implementation of the “Alpha Key Protocols” (Seller Shield, Resolution Pivot, Integrity Fortress) does not generate a verified minimum of €3.300.000 in new operational value, the difference will be credited via performance-based advisory services. (See Section 10 of the Audit for full covenant details.)

Forensic Scope

This 35-page strategic dossier performs an “Organisational CT Scan” on Vinted’s operational infrastructure, revealing a “Schrödinger’s Cat” paradox: highly efficient financials masking deep systemic decay in the customer asset.

The report delivers three proprietary assets:

The Diagnostic Data: A granular calculation of the Asset Inefficiency Score (AIS: 54.6%), pinpointing exactly where €444.12M in annual revenue is leaking.

The Execution Protocols: A surgical, step-by-step operational restructuring plan to reduce returns velocity by 48%and stabilise the user base.

The Alpha Vault (B2B Engine): The complete business case for “Vinted Services”—a strategy to monetise Vinted’s inventory data into a recurring revenue stream targeting the €138B Global Insights market.

Target Acquirer Profile

Private Equity & Deal Teams: Use this as your Pre-Bid Operational Due Diligence. Identify the exact levers to pull post-acquisition to double the multiple.

Vinted Board & C-Suite: This is your Defense Strategy against a down-round or post-IPO correction. Secure the narrative and the numbers before the roadshow.

Conglomerates: Acquire the blueprint for the secondary market data ecosystem before your competitors do.

Asset Specifications

Report: Subject to local applicable taxes.

Format: Digital Dossier (PDF).

Clearance: Restricted to Accredited Investors and Corporate Entities.

Delivery: Instant Secure Transfer upon remittance.