Image 1 of 5

Image 1 of 5

Image 2 of 5

Image 2 of 5

Image 3 of 5

Image 3 of 5

Image 4 of 5

Image 4 of 5

Image 5 of 5

Image 5 of 5

The Alpha Key™ Audit – TIMBERLAND (VF CORP)

AN ASYMMETRIC INVESTMENT OPPORTUNITY

This 37-page report is a restricted-access forensic audit designed for Institutional Investors, Activist Shareholders, and the VF Corporation Executive Leadership Team.

It creates a verifiable bridge between Timberland’s current status as a “Distressed Heritage Giant” and a realised US$ 2.51 Billion Enterprise Value Uplift.

For an acquisition investment of US$ 387,000*, you are securing the architectural blueprint to capture the “Lost Decade” of value. This document is not “market research”; it is a shovel-ready execution roadmap that transforms operational friction into immediate, compoundable equity.

THE FINANCIAL LOGIC

The price of this asset is mathematically derived from its minimum guaranteed output:

The Upside: US$ 2.51 Billion in Total Enterprise Value Uplift.

The Cost: US$ 387,000*.

The Arbitrage: Your investment is 0.015% of the identified value potential to secure the roadmap.

*See Asset Specifications below.

THE 10X CONTRACTUAL GUARANTEE

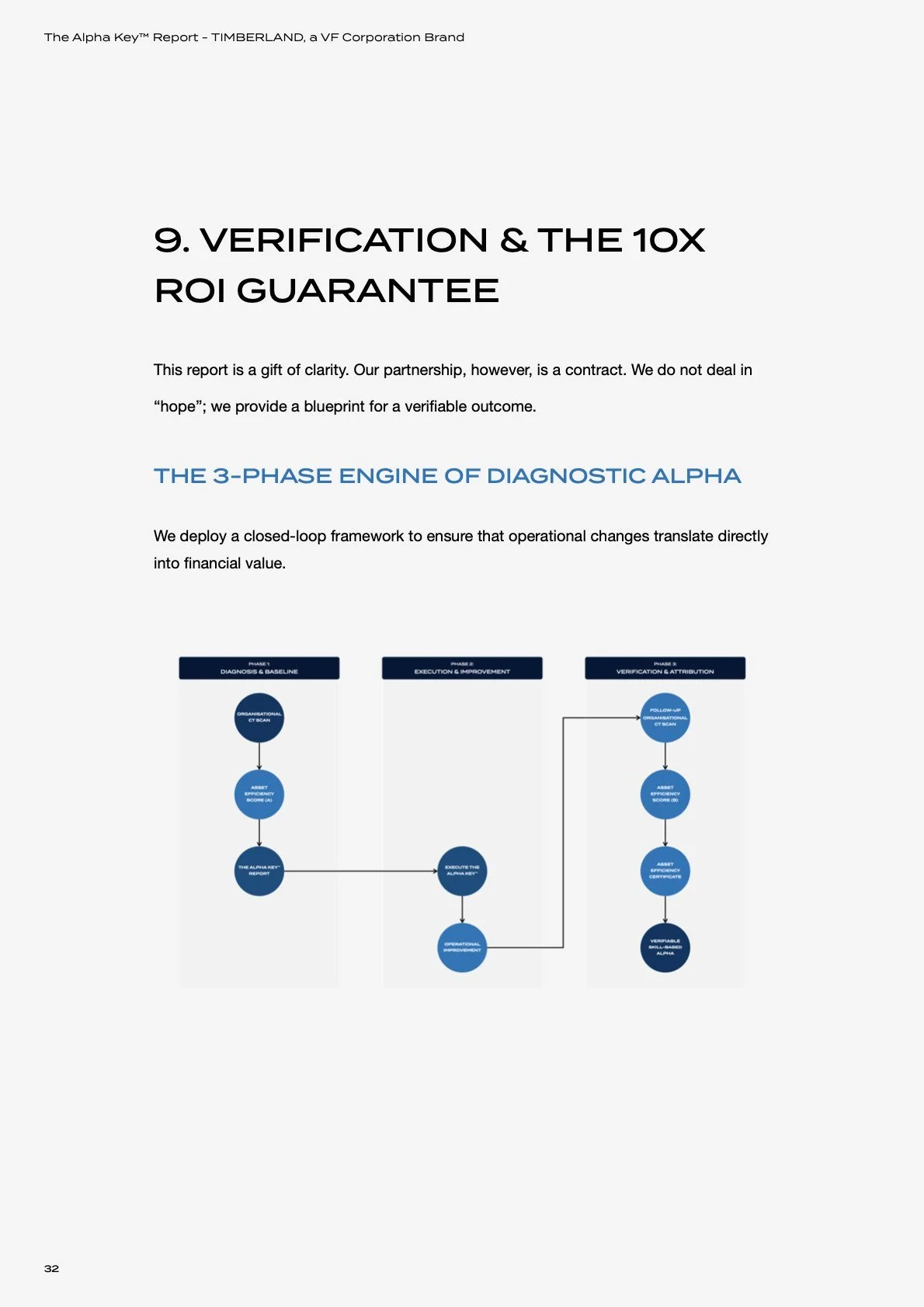

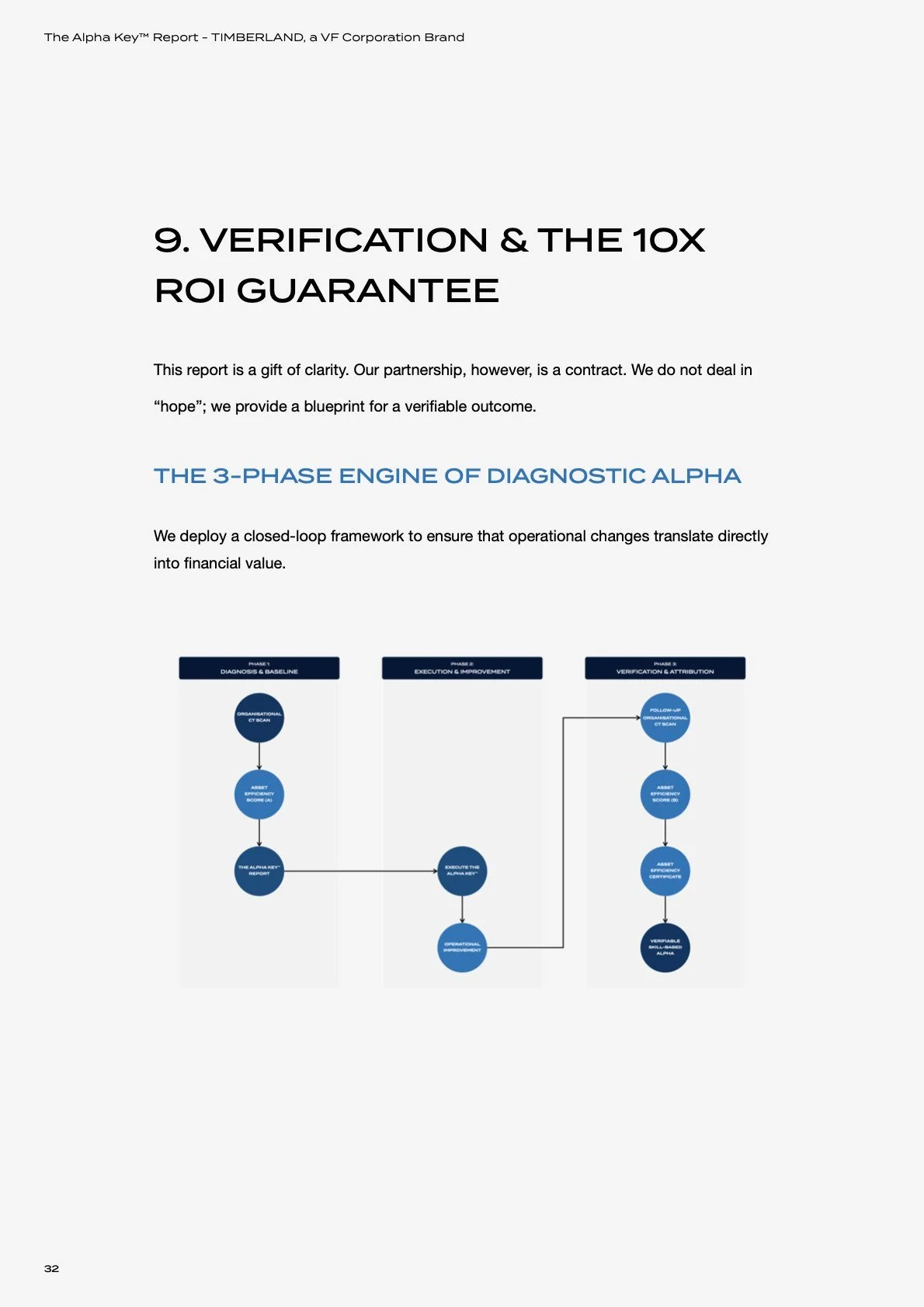

We do not sell theory. We sell outcomes. The purchase of this audit includes a binding 10X ROI Performance Guarantee.

If the implementation of the “Alpha Key Protocols” (The Last-Mile Shield, The Heritage Integrity Pivot, The Human Bridge) does not generate a verified minimum of US$ 3.87 Million in new operational value, the difference will be credited via performance-based advisory services. (See Section 9 of the Audit for full covenant details.)

FORENSIC SCOPE

This 37-page strategic dossier performs an “Organisational CT Scan” on Timberland’s operational infrastructure, revealing a “Schrödinger’s Paradox”: a brand that has won the war for Awareness but is losing the war for Customer Trust.

The report delivers three proprietary assets:

The Diagnostic Data: A granular calculation of the Asset Inefficiency Score (AIS: 74.6%), pinpointing exactly where US$ 1.199 Billion in revenue potential is eroding through the “Invisible Gorilla” of logistics and product friction.

The Execution Protocols: A surgical, step-by-step operational restructuring plan to neutralise the “Rose Anvil” contagion, eliminate “Yodel” logistics failures, and restore the US$ 149.9 Million annual profit baseline.

The Alpha Vault: The complete business case for “Verified Durability”—a strategy to unlock the “Luxe Utility” pricing tier ($300+) and finally breach the US$ 3 Billion revenue ceiling.

TARGET ACQUIRER PROFILE

VF Corporation Board & C-Suite: This is your defence strategy against further goodwill impairments (following the 2024 write-down). Secure the numbers to reverse the “14 Years in the Red” acquisition deficit.

Activist Investors: Use this as your forensic evidence for urgent operational restructuring. Identify the exact levers to pull to separate “Management Homeostasis” from shareholder value.

Institutional Capital: Acquire the blueprint that converts a “stagnant heritage asset” into an “anti-fragile utility icon.”

ASSET SPECIFICATIONS

Report: Subject to local applicable taxes.

Format: Digital Dossier (PDF).

Clearance: Restricted to Accredited Investors and Corporate Entities.

Settlement Protocol: To comply with local banking jurisdiction, this transaction is settled in Euros (€330,000). This fixed amount is calculated to approximate the US$ 387,000 asset value.

Delivery: Instant Secure Transfer upon remittance.

AN ASYMMETRIC INVESTMENT OPPORTUNITY

This 37-page report is a restricted-access forensic audit designed for Institutional Investors, Activist Shareholders, and the VF Corporation Executive Leadership Team.

It creates a verifiable bridge between Timberland’s current status as a “Distressed Heritage Giant” and a realised US$ 2.51 Billion Enterprise Value Uplift.

For an acquisition investment of US$ 387,000*, you are securing the architectural blueprint to capture the “Lost Decade” of value. This document is not “market research”; it is a shovel-ready execution roadmap that transforms operational friction into immediate, compoundable equity.

THE FINANCIAL LOGIC

The price of this asset is mathematically derived from its minimum guaranteed output:

The Upside: US$ 2.51 Billion in Total Enterprise Value Uplift.

The Cost: US$ 387,000*.

The Arbitrage: Your investment is 0.015% of the identified value potential to secure the roadmap.

*See Asset Specifications below.

THE 10X CONTRACTUAL GUARANTEE

We do not sell theory. We sell outcomes. The purchase of this audit includes a binding 10X ROI Performance Guarantee.

If the implementation of the “Alpha Key Protocols” (The Last-Mile Shield, The Heritage Integrity Pivot, The Human Bridge) does not generate a verified minimum of US$ 3.87 Million in new operational value, the difference will be credited via performance-based advisory services. (See Section 9 of the Audit for full covenant details.)

FORENSIC SCOPE

This 37-page strategic dossier performs an “Organisational CT Scan” on Timberland’s operational infrastructure, revealing a “Schrödinger’s Paradox”: a brand that has won the war for Awareness but is losing the war for Customer Trust.

The report delivers three proprietary assets:

The Diagnostic Data: A granular calculation of the Asset Inefficiency Score (AIS: 74.6%), pinpointing exactly where US$ 1.199 Billion in revenue potential is eroding through the “Invisible Gorilla” of logistics and product friction.

The Execution Protocols: A surgical, step-by-step operational restructuring plan to neutralise the “Rose Anvil” contagion, eliminate “Yodel” logistics failures, and restore the US$ 149.9 Million annual profit baseline.

The Alpha Vault: The complete business case for “Verified Durability”—a strategy to unlock the “Luxe Utility” pricing tier ($300+) and finally breach the US$ 3 Billion revenue ceiling.

TARGET ACQUIRER PROFILE

VF Corporation Board & C-Suite: This is your defence strategy against further goodwill impairments (following the 2024 write-down). Secure the numbers to reverse the “14 Years in the Red” acquisition deficit.

Activist Investors: Use this as your forensic evidence for urgent operational restructuring. Identify the exact levers to pull to separate “Management Homeostasis” from shareholder value.

Institutional Capital: Acquire the blueprint that converts a “stagnant heritage asset” into an “anti-fragile utility icon.”

ASSET SPECIFICATIONS

Report: Subject to local applicable taxes.

Format: Digital Dossier (PDF).

Clearance: Restricted to Accredited Investors and Corporate Entities.

Settlement Protocol: To comply with local banking jurisdiction, this transaction is settled in Euros (€330,000). This fixed amount is calculated to approximate the US$ 387,000 asset value.

Delivery: Instant Secure Transfer upon remittance.